Congress is making a bipartisan effort to preserve Pell Grants for low-income students by cutting back on subsidized loans for graduate students.

Sen. Judith Zaffirini, D-Laredo, said until Congress finalizes a budget, it is hard to know what will happen to Pell Grants.

“It is my hope that federal lawmakers will see through the partisanship and realize that preserving Pell Grants not only helps students, but also is in the best interest of the U.S.,” she said in an email.

At a time when the Texas Legislature has cut back on programs like TEXAS Grants, and the B-On-Time loan program, reducing Pell Grants would worsen the impact of cuts, Zaffirini said.

“Cuts to federal Pell Grant program would impact Texas negatively, especially because our state has so many low-income students,” she said.

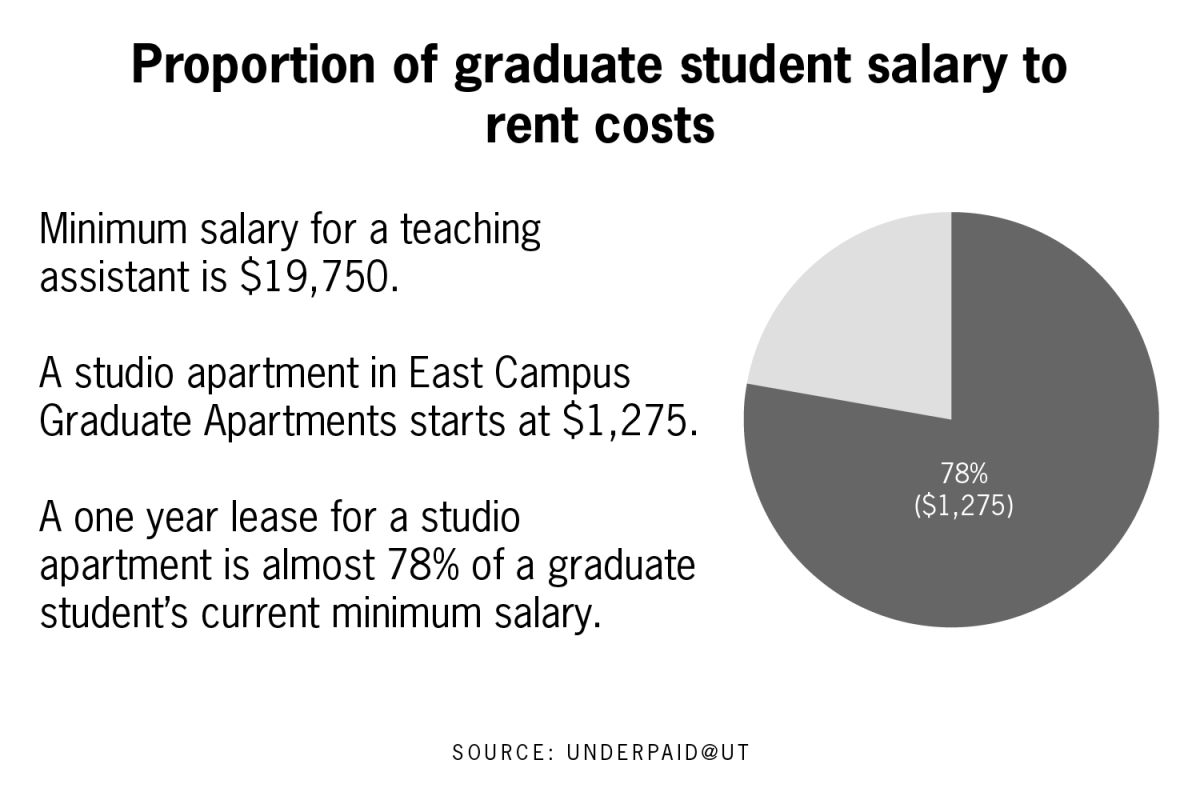

Tom Melecki, director of Student Financial Services, said the proposal would save the maximum amount of Pell Grants but eliminate subsidized loan programs for graduate students. These students will have more loans to pay off after school, he said.

At UT, about 4,000 to 5,000 graduate students take out subsidized and unsubsidized loans, Melecki said. Interest begins to accumulate on unsubsidized loans as soon as the loans are taken out, while students are still in school, he said.

“Some of the money graduate students can now borrow is subsidized,” Melecki said. “The government pays the interest while the student is in school and for the first six months after the student graduates.”

If graduate students only have the option of unsubsidized loans, they will be paying off more interest once they get out of school, Melecki said.

The proposal to eliminate subsidized loans is a bipartisan effort. The maximum amount in Pell Grants a student can receive in a year is $5,500 — a loan that students don’t have to pay off. Eliminating subsidized loans is a better option in many ways, Melecki said.

Graduate Student Assembly President Manny Gonzalez said graduate students are expressing concern about removing subsidized loan programs.

“It will make graduate education that much pricier,” Gonzalez said.

He said many graduate students take out loans because they are not funded through their programs. Eliminating subsidized loans will make it especially harder on out-of-state and international students to pay for their education, Gonzalez said.

“It’s really detrimental to maintaining a highly educated work force,” he said.

Beth Bokuski, a higher education administration graduate student, said she was able to pay off loans for her bachelor’s and master’s degrees but she had to take out more loans for her doctoral degree.

She said because she comes from a middle-class background, she doesn’t mind taking out loans because her parents are willing to help her pay them back. Students from low-income families might not have the same flexibility, she said.

“If you want an education, you’re going to have to take out loans,” Bokuski said. “It’s a hardship, but what are you going

to do?”

Printed on Monday, August 8, 2011 as: Subsidized loans may see less funding to save Pell Grants