College students across the nation are paying less money out of their pockets for tuition but are becoming increasingly reliant on financial aid and scholarships, according to a report by educational loan firm Sallie Mae and Ipsos Public Affairs.

Across all income groups, students are paying 9 percent less on overall tuition and living expenses this academic year, according to the report. Approximately 82 percent of middle class families applied for financial aid, while 86 percent of low-income families were awarded funding, according to the report.

Despite the decline in out-of-pocket expenses, UT students are still paying 12 percent more on average for their undergraduate degree compared to the new national average of $21,889 per year. UT students are likely to receive 48 percent of their individual funding in the form of grants and scholarships compared to a national average of 33 percent, which has increased from 10 percent a year ago.

Patricia Christel, a spokeswoman for Sallie Mae, said the findings of the study indicate increasingly cost-conscious families looking to save money by applying for any and all grants and scholarships available.

“The [national] decline results from a number of factors, including a shift to lower-cost schools, an increase in the numbers of low-income students attending college, and reduced out-of-pocket spending among high and middle-income families,” Christel said. “One major factor in the increase in the proportion of college costs met from scholarships and grants is that for the first time since the study began [in 2008], more families filed the Free Application for Federal Student Aid (FAFSA), which jumped from 72 percent in the 2010 report to 80 percent in the 2011 report.”

Tom Melecki, director of Student Financial Services, said the findings of the report were consistent with an increase in UT students participating in savings seminars conducted by the Office of Student Financial Services.

“We’ve seen a large increase in the number of students filing FAFSAs, we’re even seeing students who might not have thought they needed to apply for need-based financial aid during their first year here,” Melecki said. “We provide a little more grant funding for the students of families whose parents are least able to pay.”

In the 2010-2011 academic year, more than $367.3 million was awarded to UT students according to figures provided by the Office. A boost in the amount of federal funding for Pell Grants is predicted to increase the amount available in 2011-2012 academic year to $48.6 million, up substantially from $42.1 million in the previous year despite a similar number of applicants.

Mary Fallon, a spokeswoman for Student Financial Aid Services Inc., a student aid advisory firm, said the biggest increase in applications came from middle-income families for the 2011-2012 academic year.

“Competition for financial aid is always fierce because prices are going up and the number of students who need aid is getting higher as the recession puts the pinch on everybody,” she said.

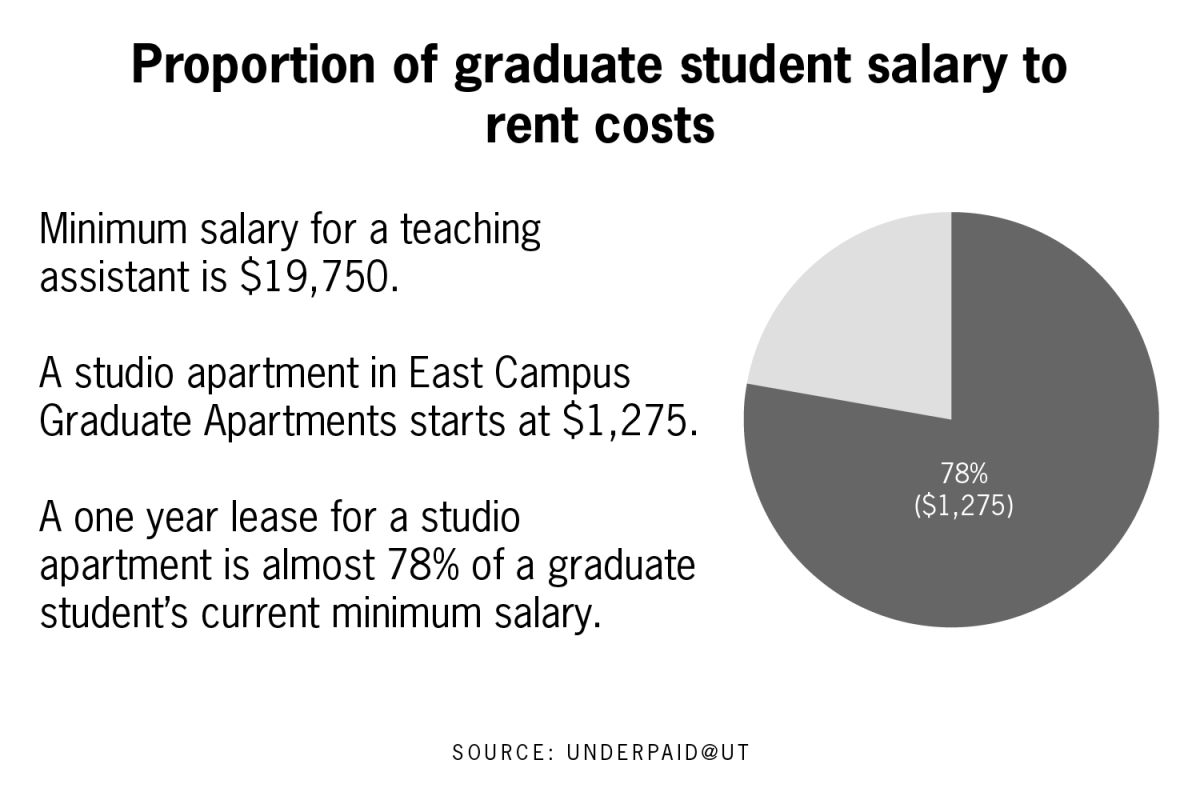

Ajit Kumar, a senior chemical engineering major, said the cost of his undergraduate degree at UT exceeded his initial budget due to increasing tuition and cost of living factors.

“Students in the past have paid much less for tuition and received more benefits than what’s currently available,” he said. “Since moving out of the dormitories I’ve had to be careful about costs, housing prices and lifestyle necessities have all become much more pricey. Austin certainly isn’t getting cheaper to live.”

Printed on August 30, 2011 as: Students depend less on parents, more on financial aid for tuiton