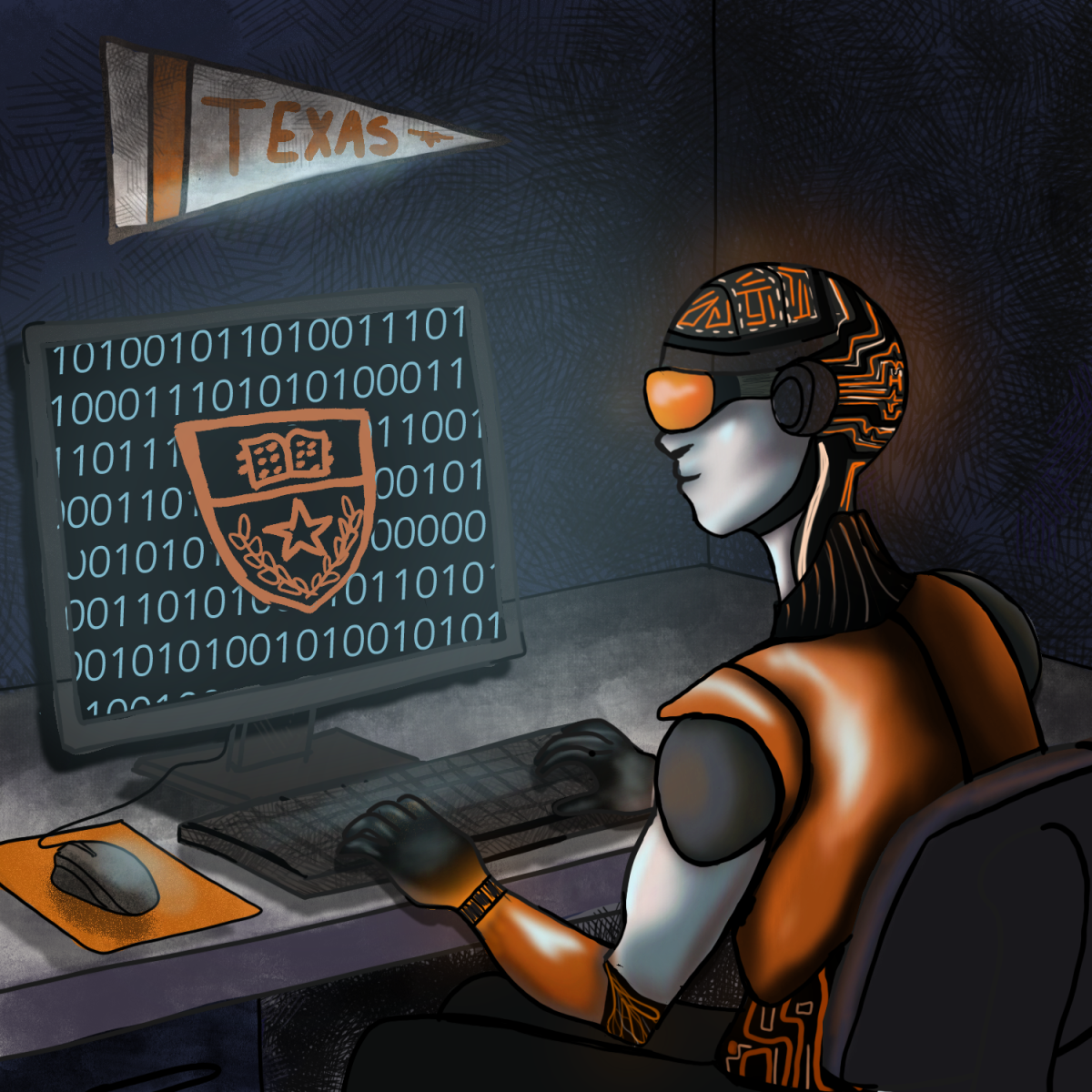

After my first time watching the movie “The Social Network,” I remember one thing: I wanted to start a business. The movie depicted a young Mark Zuckerberg working out of his dorm and creating one of the greatest technology companies that exists today — Facebook. “Startup” has been a buzzword for many years now, and it’s often associated with progress, technology and wealth. Unfortunately, translating the dramatic success within the movie to reality may not be as easy as it appears.

In the movie, Mark Zuckerberg had a friend named Eduardo Saverin who provided Zuckerberg with thousands of dollars to get Facebook off of the ground and running. The problem is most students do not have a friend who can casually provide them thousands of dollars of seed investment. The solution? Student-run venture capital firms.

The relationship between venture capital firms, a pooled fund of money that is used to invest in startup companies, and startups themselves is crucial to success. A company pitches their ideas to a VC firm, which can then choose to invest in the company for a piece of equity.

The issue of not having initial investment occurs when startups need a small amount of money to create a product. Often it costs money to make money, and many students just don’t have the capital to create a product, even if the product is revolutionary. This is when a student VC firm comes into play.

A student VC is a venture capital firm run by students, for students. Rather than making multimillion-dollar investments, a student VC firm would make smaller-scale investments between $5,000 to $25,000. This allows more startups to emerge because the startups would have the capital to push or develop their product.

This model is unique to a student VC because the model for a traditional VC functions on getting a huge return on investment and actually making money. Making tiny investments doesn’t make sense for them because they get a negligible return on investment, if any. A student VC, however, isn’t focused on getting a return on investment but rather propping up companies and giving opportunity to students.

It’s extremely important that universities start employing this model because it allows entrepreneurship to be fostered. The University of Texas is ideal for such a model because of our city’s technology-centric model. One initiative has manifested at UT in the form of the Discovery Fund. The program is a proposed student-run VC firm here on campus. While the program hasn’t officially launched yet, its arrival will expedite the progress of our institution rapidly. With programs such as the Longhorn Startup Lab, Freshman Founders and HackTX, UT is on track to become one of the most innovative, disruptive universities in the world.

Syed is a biochemistry freshman from Houston. Syed is an Associate Editor. Follow him on Twitter @mohammadasyed.