Tuition is due Jan. 4, and for 56 percent of undergraduate students at UT Austin, that means relying on financial aid to help cover their cost of attendance.

Tom Melecki, director of the Office of Student Financial Services, said complex federal and state laws can both help and hinder students’ access to financial aid. A push to tie financial aid to timely graduation could also be coming at the University and state level, Melecki said.

Familiarity with how student aid is distributed could be the key to keeping student borrowing to a minimum, Melecki said.

“We try to go to grants and scholarships first, but the number of people needing aid is far greater than the amount we give out in grants and scholarships,” Melecki said.

In the 2011-2012 academic year, the office distributed more than $58.5 million in scholarships and $102.4 million in grants to undergraduate students, according to University OSFS documents. Students also took out more than $204.6 million in loans through the office.

“I can guarantee you that there is no way this office can fund more than a handful of students .. to have sufficient grant and scholarship aid to totally cover their costs,” Melecki said. “It means they are going to borrow.”

When borrowing, most students in the United States are unaware of the differences between the federal aid resources offered to them, said Matt Reed, program director of the Institute for College Access and Success.

“We do know from research in 2007-2008 that the majority of undergraduate borrowers did not understand the differences between the different types of student loans or their interest rates,” Reed said.

Former UT student Ashley Pierce said when she began at UT in 2002 at age 17, she was too young to qualify for a federal student loan because she had graduated from high school early. Her parents had to cosign loans from private lenders to finance her education.

“I had no way of knowing a 25 percent interest rate was bad,” Pierce said. “I had not bought a house or a car. I wasn’t even 18-years-old. As a result, I ended up with tons and tons of private student loans with astronomical interest rates that pretty much have no feasible plan for repayment.”

Pierce said her debt totals $38,000, and it grows every day despite her $60,000 annual salary.

“I have a great job and I’m a great citizen,” Pierce said. “I’m very responsible, but I have an astronomical amount of student loan debt just as a result of bad decisions.”

UT no longer recommends private lenders to students, Melecki said. Once students have exhausted debt-free resources, the Office of Student Financial Aid must advise them of federal unsubsidized and subsidized loans, Melecki said. The average student debt for UT undergraduates who graduated last year and who have taken loans was $25,192 for the last academic year, less than the national average of $26,600. UT made a total of $138 million in loans to students in the 2011-2012 academic year.

Melecki said the first loans students are advised to take are direct federal subsidized loans. These loans include Perkins Loans, which were funded by Congress. This program no longer receives annual government funding and is sustained by payments made by former loan recipients, Melecki said. This creates a revolving $8 million fund from which the University lends to its neediest students at a 5 percent interest rate. Students must begin paying the loan back six months after graduation.

Students demonstrating financial need are also able to receive subsidized loans through the Federal Direct program, Melecki said. These loans have a 3.4 percent interest rate and don’t accrue interest until six months after the student graduates.

Unsubsidized student loans, which 14,083 students took out last year, have a 6.8 percent interest rate and accrue interest from the day the loan was disbursed. Students without demonstrated financial need can take out these loans.

Aside from these personal loans, parents of students can also sign for an unsubsidized loan at a 7.9 percent interest rate.

When parent loans were first created in the 1980s by the federal government, they were not intended for the extensive borrowing students utilize them for today, Melecki said.

“The envisionment was for parent and unsubsidized loans to be loans of convenience for fairly affluent families who need to meet a cash flow problem,” Melecki said. “The idea was that the unsubsidized and parent loans wouldn’t be used by those who were financially needy. We have a lot more financially needy people taking those loans now.”

For the 2011-2012 academic year, more than $66.4 million in parent loans were made to UT-Austin students.

Pierce said even financially savvy parents can fall prey to student loan debt.

“My parents are people who have perfect credit,” Pierce said. “They are homeowners. They are totally responsible adults, but I think even they didn’t realize what sort of hole we were digging into when we were signing these things every semester like it would be manageable to pay back.”

An increase in the cost of attendance, increased cost of living and decreased state and federal aid fuel the need for more loans, Melecki said.

A decade ago, the average cost of attending UT for an off-campus, in-state undergraduate was $5,340 in tuition, $7,478 for housing and $3,492 for other expenses per academic year, according to admissions documents. For the current academic year, the OSFS estimates tuition to cost between $9,346 and $10,738 per academic year, with housing costs estimated to be $10,946 for in-state undergraduates and other expenses estimated at $4,656.

Those costs directly affect the amount of debt students acquire, Pierce said.

“It seems insane that in math, the cost of going to schools continues to rise and the interest rates continue to get higher,” Pierce said. “If tuition goes up by 30 percent it isn’t fair and it doesn’t make sense for loan rates not to adjust to that.”

Meanwhile, the amount of state and federal aid available to UT students decreased by about $16 million from the 2010-2011 academic year to the 2011-2012 academic year.

In 2010 the federal government redirected $60 billion from private student loans to government grants and loans. However, stipulations on that money may negatively impact some students, Melecki said.

State-funded loan programs were classified as private in the process, Melecki said. This bars financial aid counselors from advising students to ask about state loan programs even if they are less expensive than federal loans.

“We believe there should be an exception carved out for state loans as long as you can demonstrate that terms and conditions of the loan are better than the federal loan program,” Melecki said.

Texas’ College Access Loan program lends to students at a 5.25 percent interest rate that accrues from the day students take out the loan, Melecki said. However, because the interest is never capitalized by the state, the total cost often ends up being less than federal loan programs, Melecki said.

Additionally, the state offers the zero-interest rate B-On-Time Loan program to students demonstrating financial need. Students who complete 15 hours per semester and graduate with a B average or higher have their B-On-Time loans forgiven.

Current federal law prevents financial aid counselors from advising students to take advantage of the B-On-Time loan program, Melecki said. Students must ask about it directly. As a result, the office only distributed $3.9 million of $6.7 million allocated to UT for the program, Melecki said.

“If students don’t know about the program there’s no way it can work,” state Sen. Judith Zaffirini, D-Laredo, said. Zaffirini has proposed legislation for the 2013 legislative session that she hopes will ensure the B-On-Time loan program receives adequate funding instead of further cuts. In 2011, the state cut the program by 29 percent, from $157.1 million to $111.9 million, according to The Texas Tribune.

In the state legislative session set to begin in January, the large number of new legislators will play a big role in deciding whether or not to cut funding for higher education, Zaffirini said. In the 2011 session, legislators cut $92 million from the UT budget.

“The big issue is funding,” said Zaffirini, a UT alumna. “Everyone talks about equal access and opportunity, but the big issue is funding. I, for one, will prioritize to secure more funding for

higher education.”

Some higher education policy groups propose tying loan awards to on-time graduation rather than just academic performance. Zaffirini said she opposes such a change.

UT is also considering tying some of its gift aid to number of hours completed, Melecki said.

He said beginning in the fall semester of 2013, a UT pilot project will offer 200 freshmen loan forgiveness. One hundred of the students will be offered forgiveness in the amount of $1,000 on the principal, plus interest accrued if they complete 15 hours of coursework in their degree plan, Melecki said. One hundred students will be offered forgiveness in the amount of $2,000 on the principal, plus interest accrued if they complete 30 hours in the first academic year, he said.

Students graduating on time could save $12,975 if the program were extended four years, Melecki said.

Many students say the burden of taking on student loan debt is worth it. For media entrepreneur Rubén Cantú, taking loans to obtain a master’s degree from the McCombs School of Business made all the difference in launching his business, CORE Media Enterprises.

“I studied entrepreneurship and technology commercialization, and because of that experience I can sit down in front of a venture capitalist and talk business,” Cantú said. “I can do things that I never would have been able to do, or would have taken a very long time to do because of that experience.”

Pierce said in her case, a UT education wasn’t necessarily a stepping stone to a career.

“The joke of this whole thing to me is that I got my first really cool journalism job without my degree,” Pierce said.

In addition to using financial aid, students can also think of other ways to keep from borrowing greater amounts, said Jamie Brown, a UT financial aid officer.

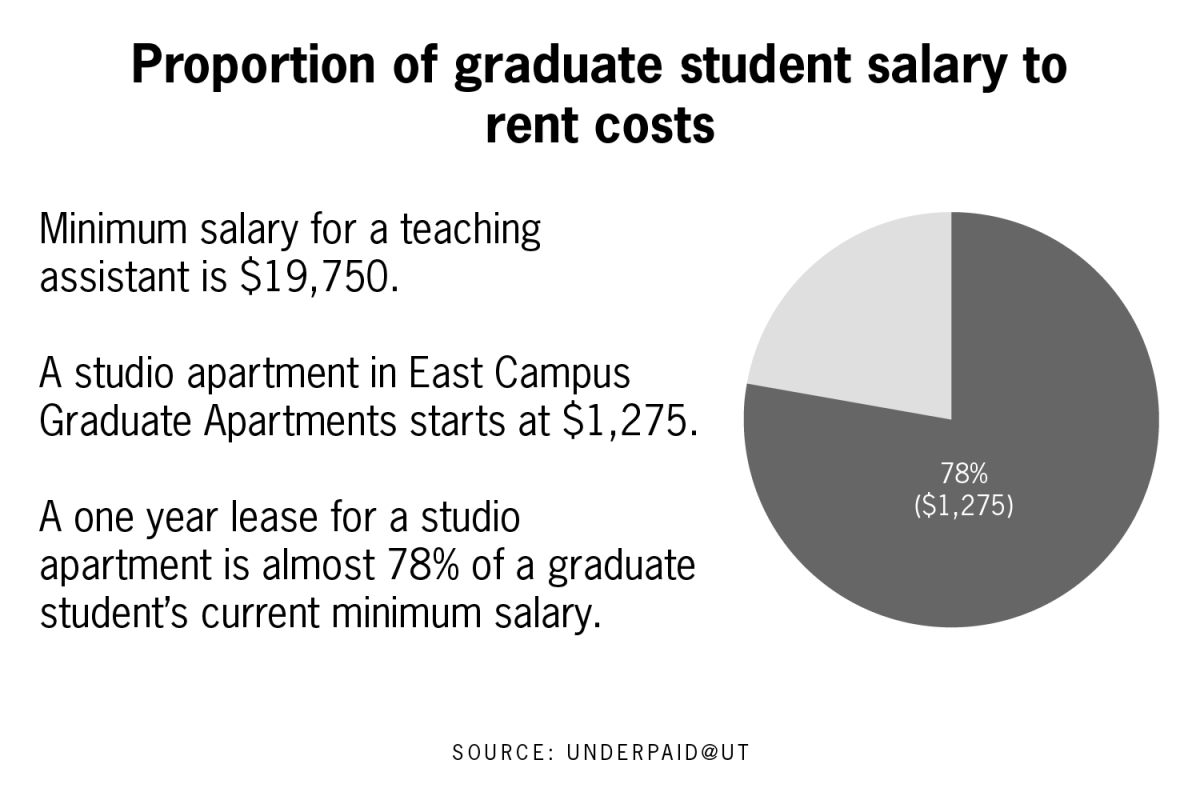

“We see students every semester who have to take emergency loans to meet rent,” Brown said. “Then we have to sit down and ask if living in an expensive West Campus apartment is really affordable for them.”

Anthropology senior Elizabeth Melville said living frugally was necessary to attend UT after she was denied sufficient financial aid in her freshman year. Melville had moved away from her mother’s home at the age of 16, and said she hadn’t received support from her since then. But since she had not been legally emancipated from her mother, many student aid officers said she could not file independently of her mother, whose income was higher than the amount needed to receive need-based aid.

“I didn’t even get enough loans to cover tuition,” Melville said. “My first few years at UT were really difficult saving up money for books and tuition.”

Melville said she worked a 20-hour on-campus job and picked up extra shifts when she could to make ends meet.

Melecki said working and living frugally to keep debt low will pay off later in life.

“UT is really just a way station to something greater,” Melecki said.

Printed on Friday, November 30, 2012 as: Tricky student loan rules lead to more debt