The Know Before You Owe initiative, as reported by The Daily Texan in Thursday’s paper, fails to address the root of the problem of student debt, which is the government’s own intervention in the education industry.

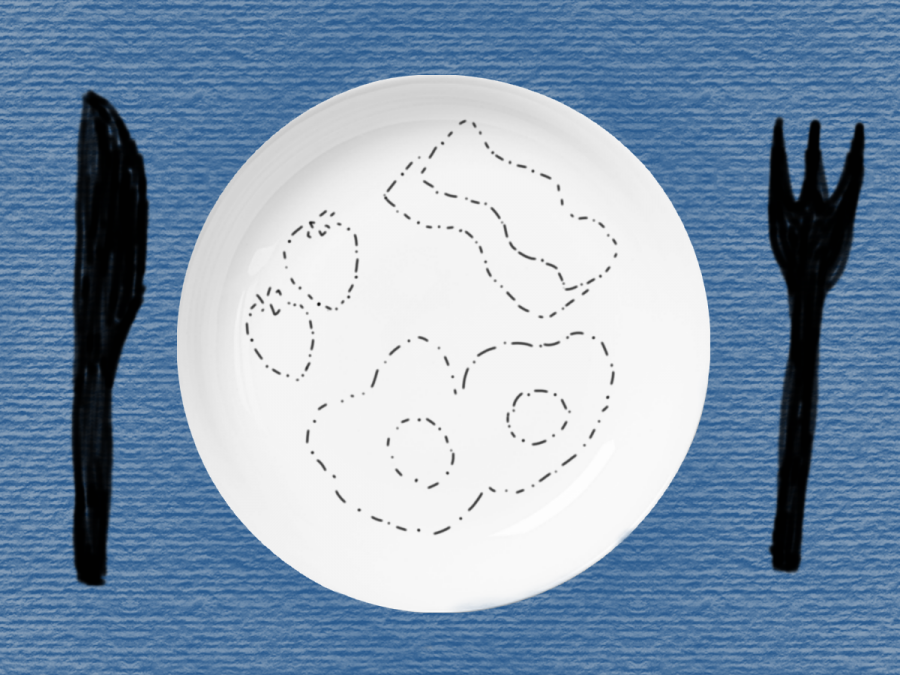

If more people have access to a college education, then the price of that education will go up. But price increases lead only to calls for more student loans, which again lead to higher tuition and more debt. But as more college degrees are granted, degrees necessarily become less valuable. If everyone has a college degree, then a college degree says no more about a job candidate than that he is a warm body. The result of government student loans is quite predictable: a generation of underemployed adults laden with crippling student loans they cannot pay.

By contrast, a system without government intrusion would be very different: No student would be able to get a loan without strong evidence that their future degree would lead to a lucrative career. People not likely to benefit from a college degree would be less likely to be approved for a loan and therefore less likely to be tricked into the mistake that so many graduates have today.

In a perfect world, not everyone will have access to a college education. The benefit a person provides to his society comes from how he differentiates himself from the rest. Some will be college-educated, but others will be educated by their own deliberate efforts, careers or experiences in everyday life.

Krawisz is electrical and computer engineering graduate student.