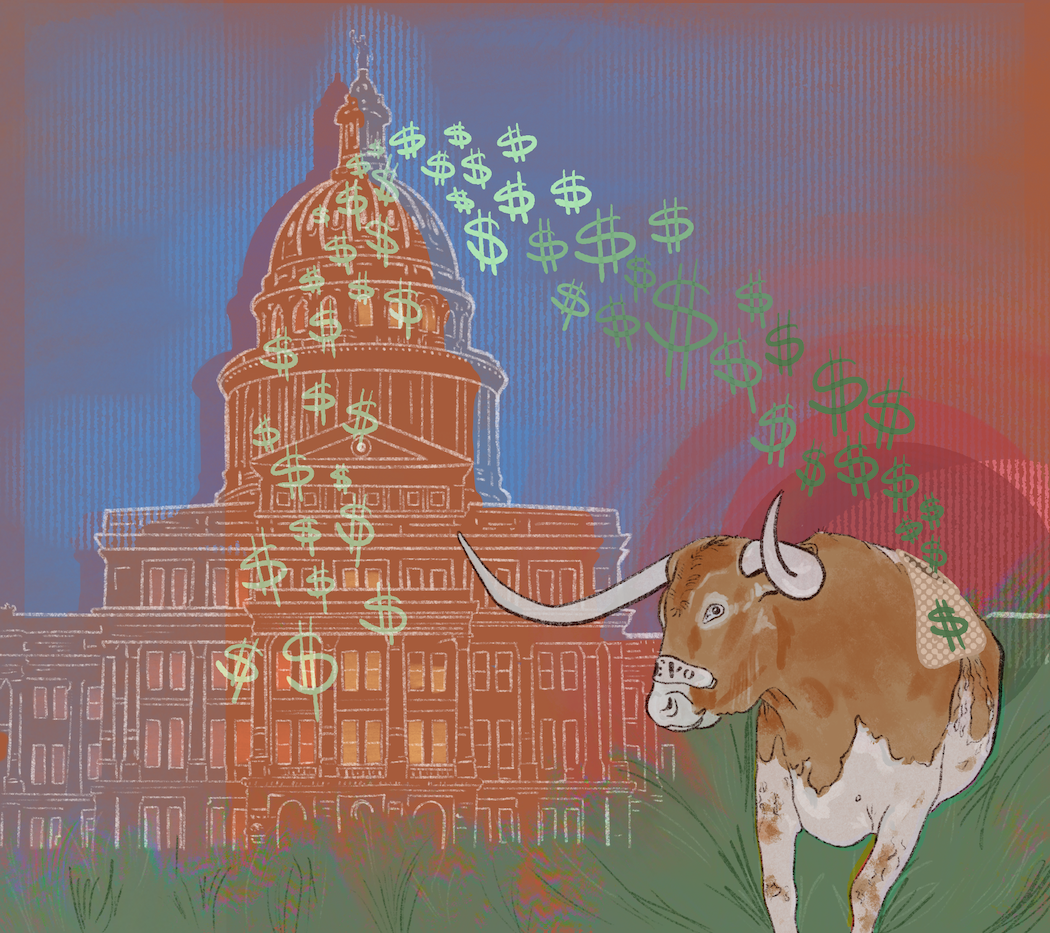

The Office of Business Affairs, which directs University Lands, sold almost $250 million of oil and gas leases Wednesday during its most lucrative semiannual lease sale in history.

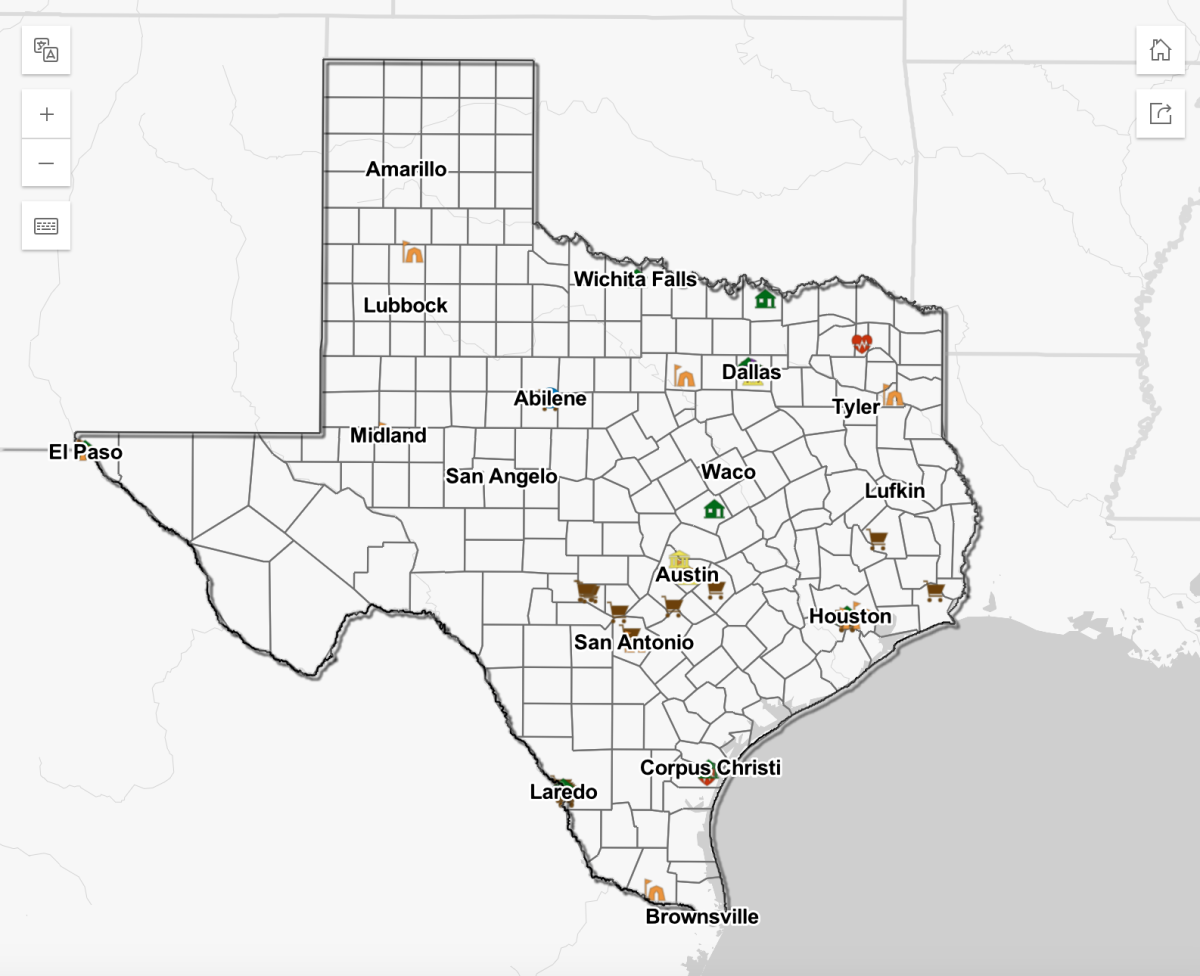

The sale included oil and gas leases for 117,000 of the 2.1 million acres of Permanent University Fund land.

The Republic of Texas set aside 220,000 acres of public land in 1839 as an endowment for a public university. Oil was first discovered on the land in 1923 in Reagan County, according to the UT System’s website.

This sale and the last one in September 2010 collected considerably more money than any previous sales, said Stephen Hartmann, executive director of University Lands, which is dedicated to managing and leasing the lands.

The September 2010 sale totaled $207 million, and the highest sale before that came in the ‘80s and totaled $52 million, Hartmann said. Other sales have topped at about $40 million.

Hartmann said oil and gas, drilling or brokerage companies bid on specific plots of land before the date of the sale based on the amount of oil or gas they think they can get from the area. He said the bidders have no way of knowing information about other bids for the plots they bid on.

He said this forces companies to bid in relation to how much they can get from the land.

“If you’re bidding on this, you take your best shot because you don’t know,” Hartmann said. “If you really want it, you better make it good. I had one guy say, ‘You ought to at least provide doughnuts for making us go through this.’ I took a look at his bids and said, ‘I should bring Wheaties instead.’”

In addition to oil and gas leases, the Land Office leases land for pipelines and fiber-optic cables, wind farms, businesses and a commercial winery.

The University of Texas Investment Management Company invests the profits from the lands that make up the Available University Fund. The University of Texas System receives two thirds of the returns on investment, and the Texas A&M University System receives one third.

For its 2010-11 budget, UT Austin received $166 million from the returns, which comprise the Available University Fund.

Much of the land is leased for multiple uses, but because the three-year oil and gas leases have different statutory requirements than the 10-year surface leases, they are sold separately, said Jim Benson, director of business operations of University Lands.

Benson said all oil and gas leases are sold in sales similar to Wednesday’s and approved by the Board for Lease of University Lands, and the rest are negotiated individually and approved by the UT System Board of Regents.

He said the office expected a successful sale because of high oil prices and political events worldwide.

“Worldwide demand and probably the instability in some of the other oil-producing regions in the world have driven people back to domestic oil,” Benson said.

He said a few key players always influence sales, but which companies bid year to year is unpredictable.

ConocoPhillips purchased tracts of land for between $500,000 and $2.3 million, according to the Land Office’s preliminary sale numbers. Official numbers will be released Thursday morning.

“We are always looking for good opportunities. We believe the tracts purchased today in Crockett and Reagan counties are among them,” said Davy Kong, a ConocoPhillips representative, in a statement for the company.

—

1. Andrews 50,414.31

2. Upton 52,400.00

3. Ward 134,918.08

4. Winkler 519,440.00

5. Schleicher 649,102.35

6. Pecos 893,836.63

7. Crane 5,037,009.54

8. Ector 5,266,078.34

9. Reagan 35,399,122.46

10. Crockett 193,864,094.51

——————————————————————————–