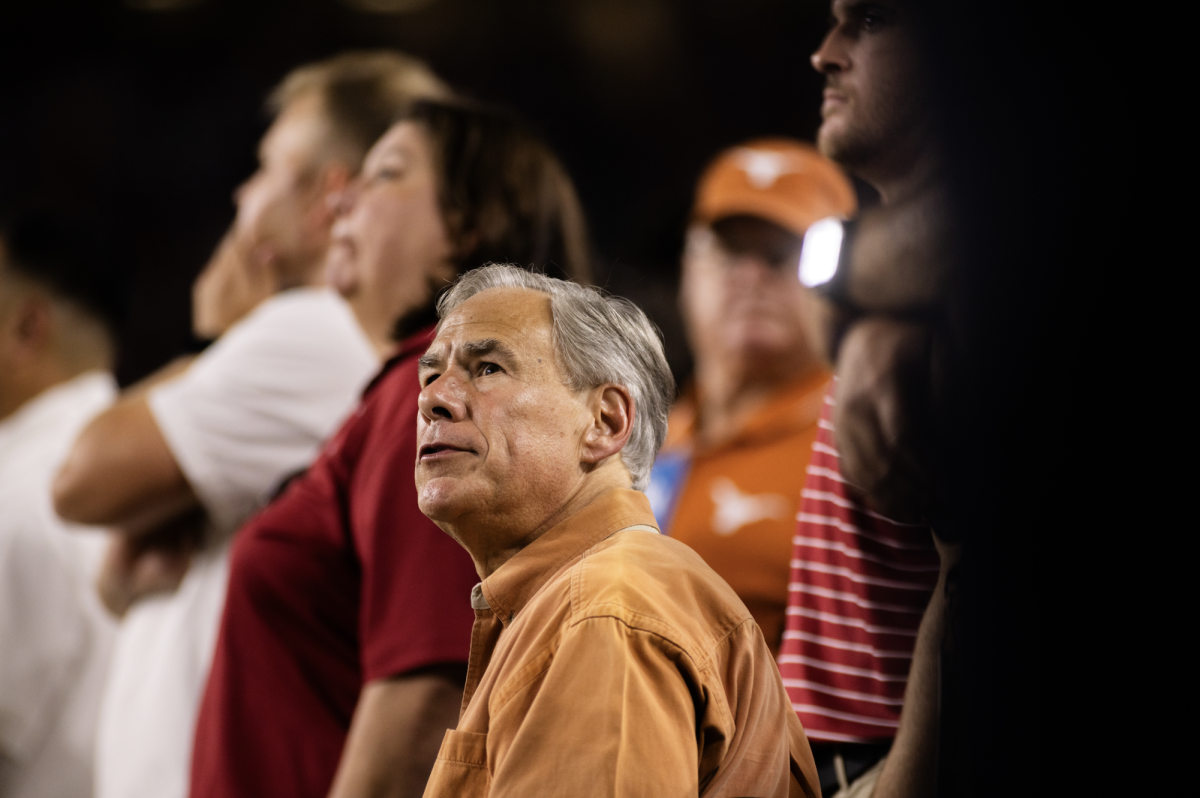

Texas Attorney General Greg Abbott launched a campaign to promote financial literacy among college students and warned the group to avoid racking up excessive credit card fees.

Abbot released a 14-minute DVD called Money Crunch, which provides strategies to avoid credit card mismanagement, during a speech at UT-San Antonio on Thursday.

The DVD reminds students that potential employers often run a credit check as part of the hiring process. A 2007 Texas law requires universities to include financial management as part of new student orientation.

Abbott encouraged students to understand credit card terms, make timely payments, understand fees, protect personal and financial information and read the contract.

Raj Raghunathan, an associate marketing administration professor, said America has a credit addiction. He said, for a credit card company, the ideal customer is one who will accrue fees.

We are addicted to plastic. America has a huge debt crisis, Raghunathan said. The amount of money people owe to credit card companies and interest is greater than any other country, and saving rates are low. It makes sense to educate students early on, to get an understanding of the consequences.

Former president of the Texas Analyst Association, Mason Klement, graduated last semester with a bachelors in finance and a minor in accounting. The association prepares UT students for careers in finance. Klement said students should set specific goals to avoid spending more than their budgets.

Im not really sure how [financially] literate each student is, he said. Sometimes its about how much control you have. It shows different levels of maturity. Its a stereotype about college being full of parties and less emphasis on studying.

Kevin Hegarty, vice president and chief financial officer at UT, said that financial counselors are available to talk one-on-one with students about any concerns. He also recommended Bevonomics, a UT series on money management, or other online resources.

You need to make a careful evaluation of the type of degree you are going to pursue if you are going to take on debt, Hegarty said.

Hegarty said the biggest obstacle for students and recent graduates is getting jobs.

Institutions of higher education become irrelevant if students arent taking that info and winning jobs, Hegarty said. Students are generally responsible, and they want to repay their debt, but obviously its difficult if they dont have a job.