Public universities and their students could be particularly vulnerable to a potential U.S. debt ceiling crisis Thursday, which would have national and global implications.

The debt ceiling marks the maximum amount of debt the U.S. is allowed to hold before it can no longer borrow money to finance federal spending. The U.S. government is projected to hit this ceiling Oct. 17 if Congress does not vote to raise the debt ceiling limit. Should the amount of debt hit the ceiling, the U.S. could be forced to default on its debt, meaning that at some point it would no longer be able to fulfill its obligations to finance programs such as Social Security and Medicare. Congress may choose to avoid defaulting by raising the debt ceiling, which would increase the amount of money the U.S. is allowed to borrow.

Olivier Coibion, assistant professor of economics and monetary policy expert, said he expects spending on public universities to be affected quickly, leading to fewer services for students, higher tuition, reduced financial aid and increased student loan interest rates. He said these changes in spending could have long-term effects on students.

“Students who finish school during an economic downturn tend to experience permanently worse careers and earn less income than those who graduate during booms,” Coibion said. “This type of economic event could have a direct and long-lived effect on students.”

Economics senior Crystal Luviano said it has been difficult to keep up with updates on the debt ceiling. She said she was unsure about how it could potentially affect students such as herself.

“But maybe if interest rates go up, student loans will be more unattainable and grants would decrease,” Luviano said. “The government wouldn’t have as many grants and scholarships to loan out to students.”

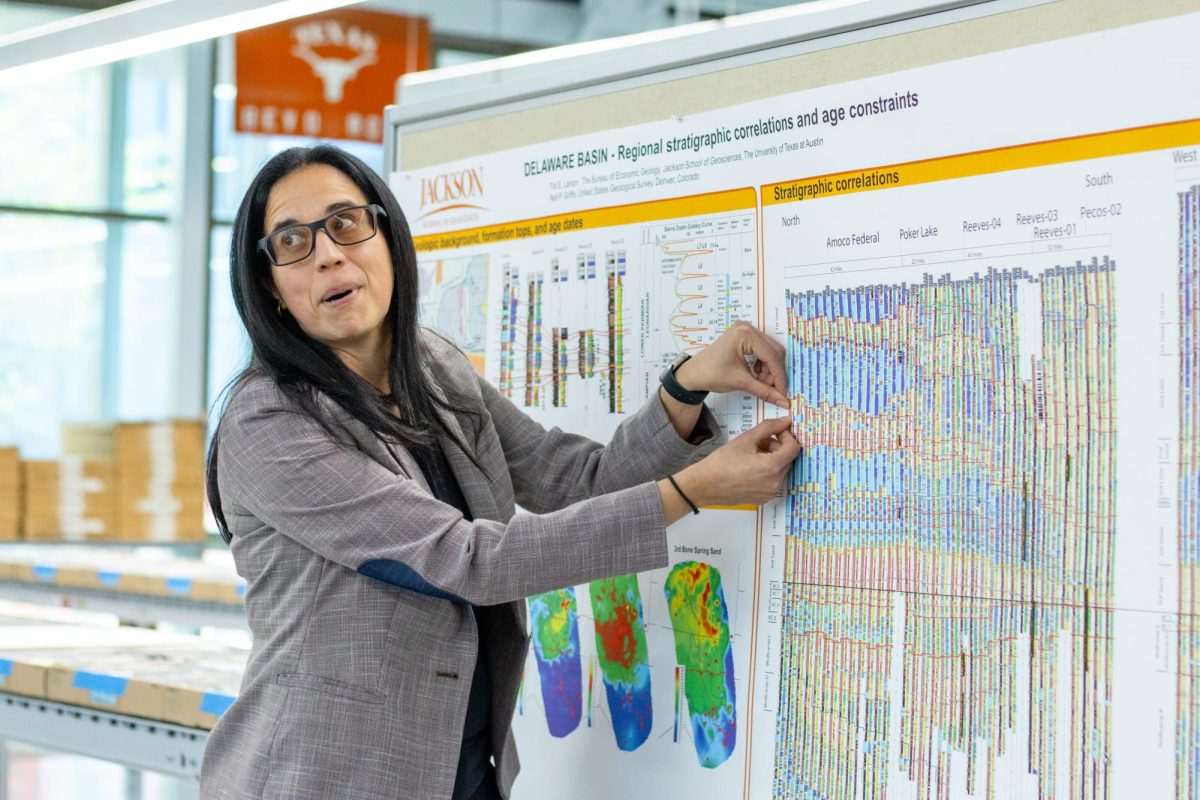

For one UT research associate, the government shutdown has already affected his research, and now the potential of hitting the debt ceiling continues to raise concerns. Joe Levy, geosciences research associate and lecturer, studies climate history by observing the ways glaciers and ice sheets have shaped the landscapes of Antarctica. His project was suspended when the government shut down.

Levy said the federal agencies that support public universities’ research have not been growing at a fast enough rate to sustain current research growth. He said defaulting would not make the possibility of funding increases look promising.

“Fewer researchers at the University will be looking for students to help with research projects,” Levy said. “Students will have fewer opportunities for summer internships and labs. That’s a pity, because it’s great to be in a place where students are doing pretty cutting-edge research.”

Lewis Spellman, finance professor and capital markets expert, said even if the debt ceiling is raised, it would force the U.S. to contemplate where its values lie.

“If we blow past our credit limit and keeping on spending, in the short run, income is generated, but in the long run, the debt can’t be paid,” Spellman said. “It’s a sanity check to get us to understand the effect of short-term benefits of spending versus the long-term implications of having debt and to start thinking serious about these implications.”