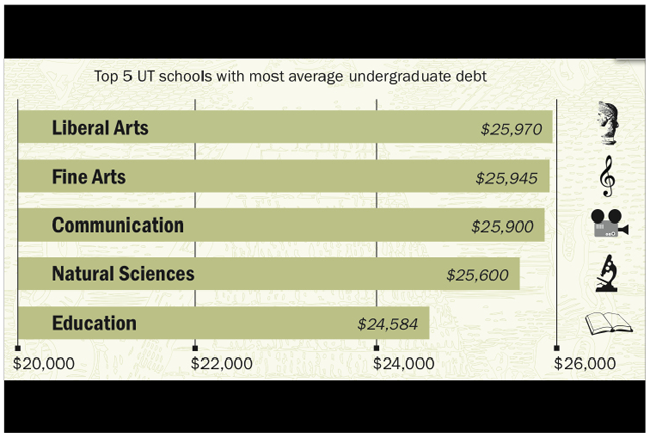

During the past school year, annual tuition between University undergraduate colleges varied by $696, but, according to a report on average student debt from the Office of Student Financial Services, student debt among May graduates varied by $3,612.

Students who received undergraduate degrees in May from the McCombs School of Business, which charges the highest tuition, had the lowest average debt, $22,358, while students from the College of Liberal Arts, which charges the lowest tuition, had the highest average debt, $25,970.

Tom Melecki, student financial services director, said there is not one specific reason for the debt variations between colleges, but many factors could contribute.

During the recession, American adults — including parents of college students — took out less loans partly because they worried about being laid off and partly because of problems with passing credit rating checks, Melecki said.

“Because people were suffering … and having trouble keeping up with paying their bills, a lot more Americans had black marks on their credit rating,” Melecki said.

Among undergraduate schools with more than fifteen borrowers, parents of McCombs students took out the highest average loans in both May 2009 and May 2014, according to the report, and parents of students in the Cockrell School of Engineering took out the lowest average loans in May 2014.

Melecki said other possible explanations for why some colleges have more debt than others could include that students in schools with more debt may be more likely to study abroad or graduate in more than four years, or the college may have less scholarship money than other colleges.

Another possible factor is that some colleges may attract more low-income students than other colleges do, Melecki said.

“My wife [who works in the School of Social Work] tells me that [some of] the students she works with … went into social work because, when they were young people, they and their families benefitted from the help of social workers,” Melecki said.

The School of Social Work was the only undergraduate college decreasing in average student debt from May 2009 to May 2014, falling from $27,610 to $23,196. The average student debt among May 2014 University undergraduates was $25,216.

Laura Wells, director of development in the School of Social Work, said this decrease could be attributed to the school working to raise more scholarship money recently. Wells said that, because social workers generally have low starting salaries, these students will face more challenges repaying their debt than students with higher starting salaries.

“While our debt is lower [than that of some other colleges], I still think they have a steeper hill to climb,” Wells said. “[The decrease in social work student debt] was really good news.”

The Jackson School of Geosciences was another school with relatively low student debt, at an average of $22,908 per student, with only six students in debt upon graduation. In 2005, the Jackson school formed after John and Katherine Jackson donated funds presently valued at more than $300 million, according to the school’s website. Nicole Evans, assistant dean for student affairs and administration, said the endowment, along with other contributions, is part of the reason the school can award between 100 and 150 scholarships, ranging from $750 to $3,450 each semester.

“We have very, very active alumni,” Evans said. “A lot of that translates into financial support being given to the school for our students.”

Melecki said he encourages students to continue searching for scholarships while they are in college, instead of only while they are in high school. The freshman class, which is the smallest undergraduate class, accounts for 44 percent of undergraduates’ outside scholarship money, according to Melecki.

According to Melecki, students who graduate in six years rather than four accrue an average of 67 percent more debt, partly because many scholarship and grant programs limit the number of renewal years. Melecki also said he thinks the federal and state governments should increase grant funding.

“If members of Congress or legislators want to know why college students have to borrow so much, one of the reasons is that the federal and state grant programs have not kept up with inflation … forcing [students] to rely more heavily on loans,” Melecki said.