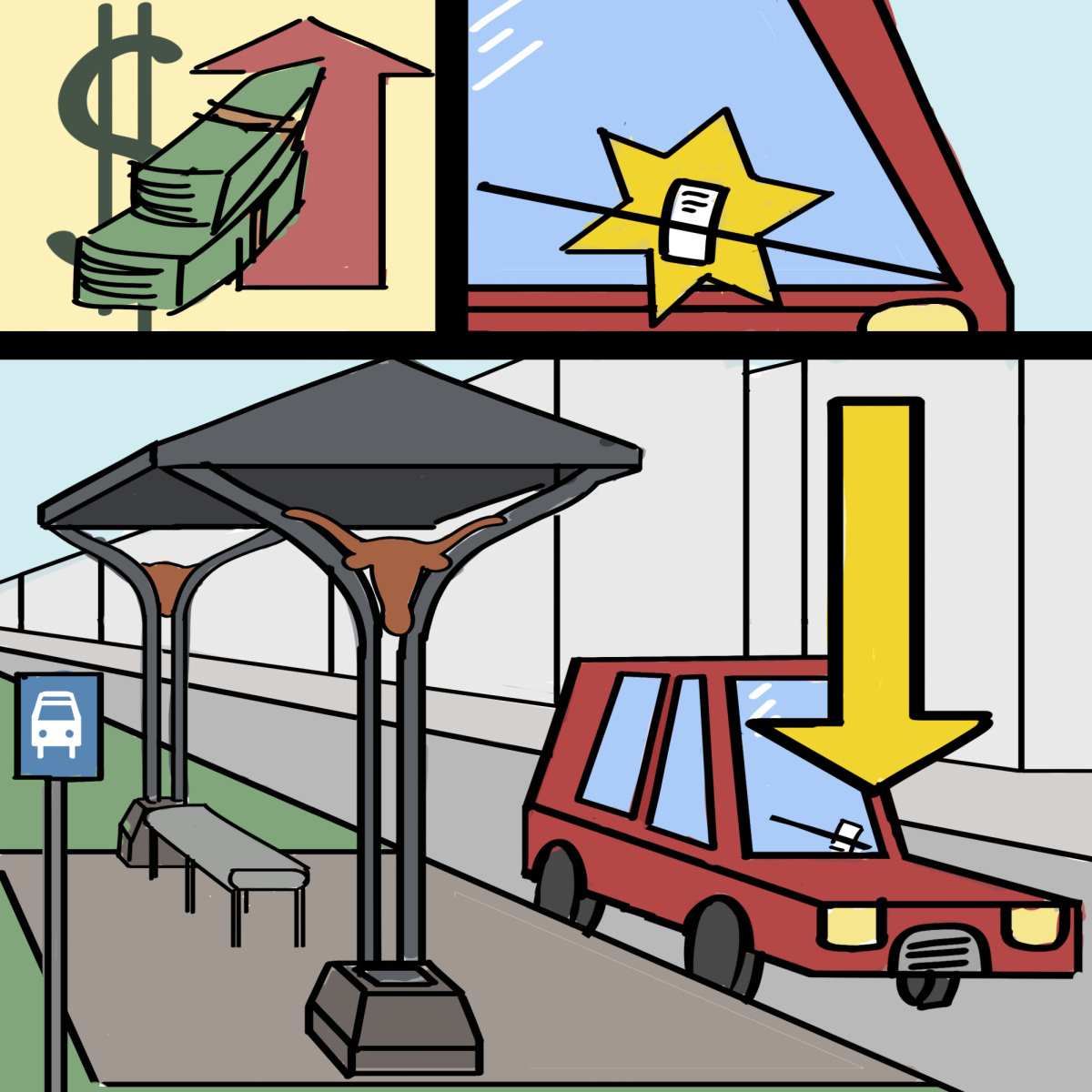

Derek Wang, a biology and Asian studies senior, received a call at the beginning of the semester from an anonymous number. The caller, who claimed he was from the Internal Revenue Service, told Wang he owed back taxes and that if he didn’t pay immediately, it would result in his arrest.

People all over the U.S. have recently been receiving these fake IRS calls asking for their personal information. Even at UT, students such as Wang are being targeted for their credit or debit card information.

“[The caller] was really aggressive and serious, but the whole experience seemed too odd to be real,” Wang said. “I knew I had to call the IRS to be sure, and it turns out the IRS never does what the caller did.”

UTPD Lt. Gregory Stephenson said the police department is trying to let people know through Campus Watch what to listen for on these calls.

“Prevention is a big thing [for UTPD],” Stephenson said. “We really try to get the word out.”

Stephenson said UT students specifically should look out for callers claiming to be from the UT Records Office who say their grades are on hold until they pay this semester’s tuition, or from the Dean of Students’ office, stating they owe money for a DUI.

Stephenson said students should regard demanding immediate payment as a red flag.

After receiving calls that seem suspicious, people are encouraged to call the IRS directly to ensure there aren’t any payment issues, according to the IRS website.

The IRS recommends people also report the incident to the Treasury Inspector General for Tax Administration and the Federal Trade Commission and use their “FTC Complaint Assistant” website.

“In recent weeks, we continue to see these telephone scams in every part of the country,” IRS Commissioner John Koskinen said in an email. “We have formal processes in place for people with tax issues. The IRS respects taxpayer rights, and these angry, shake-down calls are clear warning signs of fraud. This is not how we do business. We urge people to be careful when they get these threatening phone calls.”

Eileen Morrow, who received a fake IRS call intended for her daughter, who attends UT, said she believes the scammers are targeting college students because they are not as experienced with dealing with the IRS and don’t know how to handle such aggressive people.

“Students don’t know the ins and outs of the IRS,” Morrow said. “They give these scammers money because they don’t know any better.”