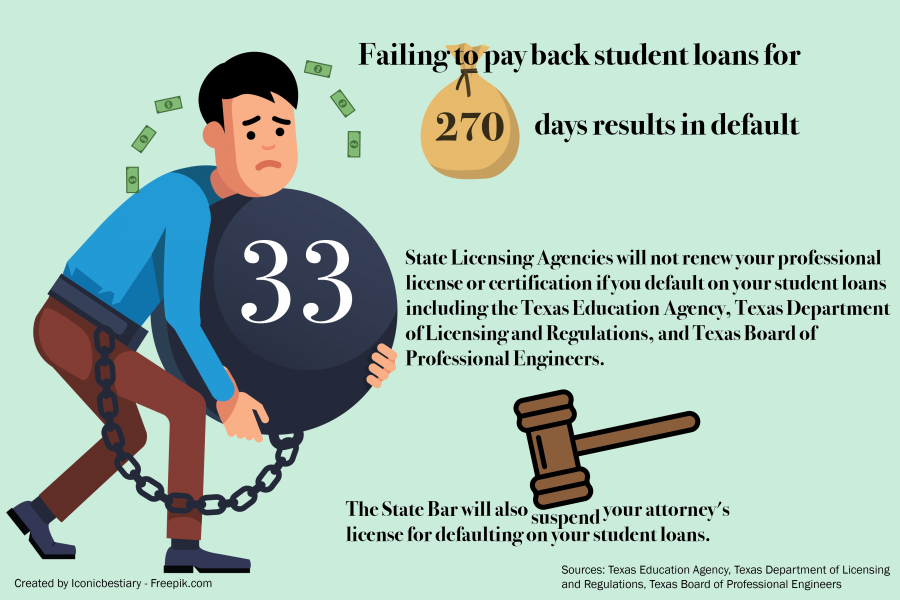

If a student loan borrower defaults on their debt, they could lose or be blocked from renewing any professional licenses or certifications they hold.

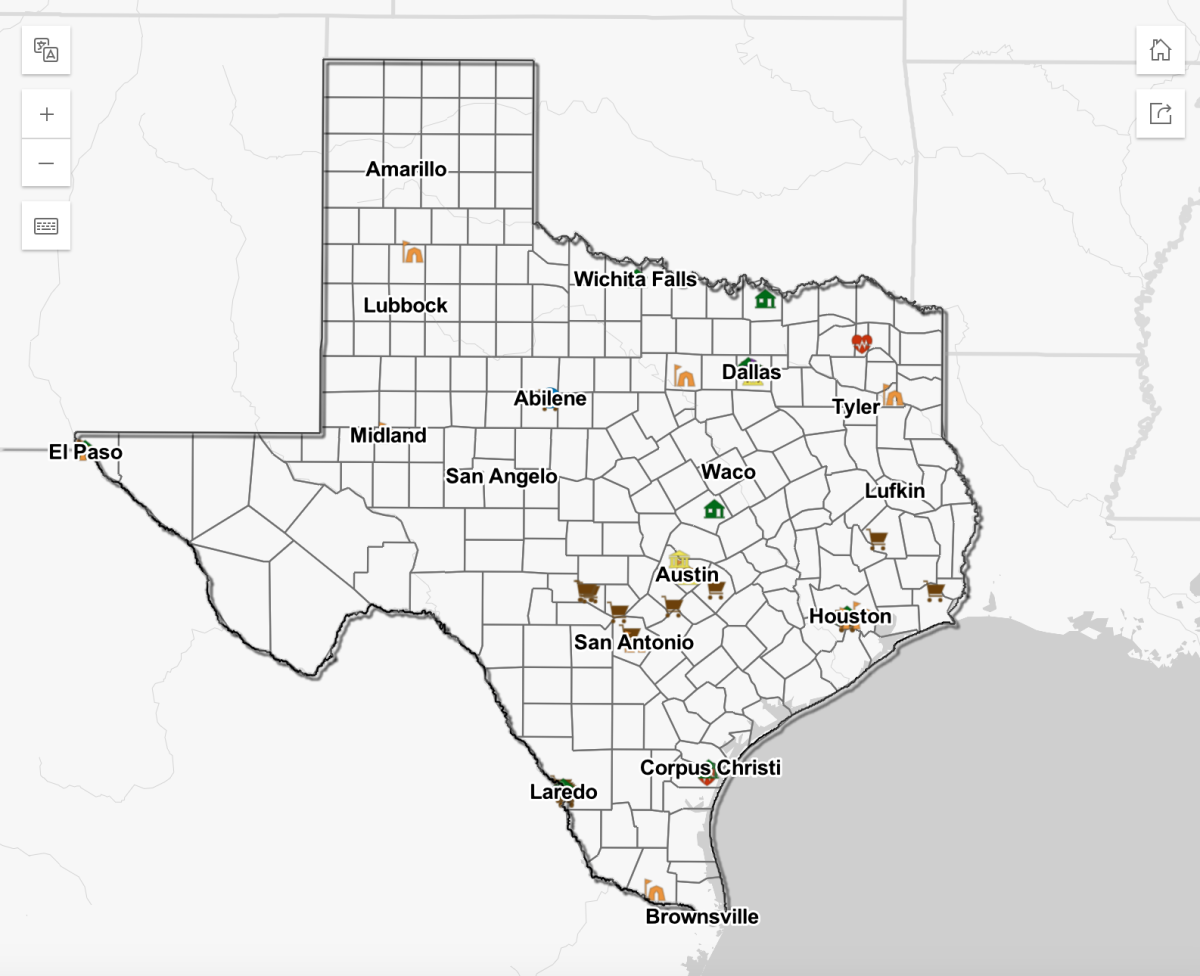

In Texas, there are 33 state agencies that will not allow borrowers who default on their loans to renew their professional license, and the State Bar, which licenses attorneys, will suspend their license for doing so. Nurse practitioners, cosmetologists, engineers and teachers are just some of the dozens of licensees who could suffer the consequences of defaulting.

For some, these penalties represent motivation to meet loan payments, but UT law professor Mechele Dickerson said they have unintended consequences for individuals who cannot afford the payments. Losing a professional license could mean the loss of a borrower’s main source of income. Without income, the borrower is robbed of the ability to make their loan payments, pushing them further into debt, Dickerson said.

“It puts an extraordinary amount of pressure on the person that needs to work,” said Dickerson, who specializes in student loan debt. “You are telling people that … if you are working in a field that is licensed by the state you cannot legally work without the license because you have not paid the student loans.”

Jan Kruse, spokesperson for the student loan borrower advocacy group National Consumer Law Center, said in an email that these policies can be detrimental.

“If people have licenses suspended then they can’t work and pay their bills so the tactic could completely backfire,” Kruse said.

Trellis Company takes default claims for the state and works with borrowers to meet their loan payments. Bryan Gilbert, director of communications for Trellis, said if a borrower goes into default, they become 270 days delinquent with their lender, and lenders decide when this delinquency period starts. At this point, the borrower has 60 days, sometimes longer, to formulate a payment plan with Trellis, Gilbert said.

“Many of the consequences are cited to the borrower during that 270 days, including the risk of losing their state license,” Gilbert said.

Once that period is up, the next time Trellis sends out its quarterly report to the 34 licensing agencies it works with, the borrower will be listed as someone who is in default and will then be prevented from renewing their professional license, Gilbert said.

“(The borrower) doesn’t go into default and automatically have their license not renewed,” Trellis supervisor Paul Miller said.

These policies likely were put in place with the model of punishing wealthy doctors and other high-income persons who have more than enough means to pay their debts, Dickerson said. However, this model represents a minority of individuals who default on their loans. More commonly, the people who are falling behind are those who went to college for a few years but couldn’t afford to finish, Dickerson said.

These individuals not only have student debt, but they also lack the degree that might get them the job they need to be able to pay it off, Dickerson said.

“We need to have an accurate model of who we think this law is targeting,” Dickerson said. “If we’re going after the plastic surgeons, I think it’s a different conversation than if we are going after someone who went to college for two years and a couple of months and has defaulted on their loans.”