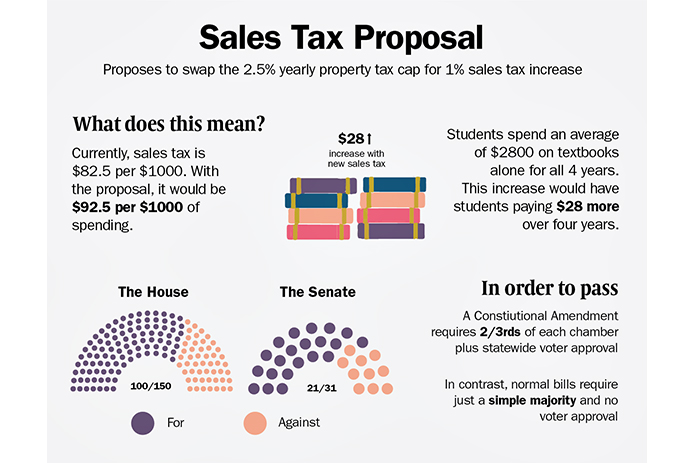

Students are unlikely to see any benefits and could even be hurt by the state’s proposal to counterbalance the property tax rate cap with an increase in the state sales tax, experts say. However, in its current form, the tax swap also faces a potentially steeper battle than other tax proposals.

The proposal would raise the state’s base rate sales tax by 1% while capping the property tax rate increase for local jurisdictions at 2.5% per year, unless it gets voter approval for a higher increase. Because people under 35 have the lowest rate of homeownership of any age group, according to the Census Bureau, Martin Luby, assistant professor of public affairs, said students will probably not receive any perks from the property tax increase cap.

In theory, Luby said, a cap on the property tax rate increases could trickle down and result in better rent prices. But in a place like Austin, where demand drives rent up much more than property taxes, the chances of lower or slower rent increases are slim, Luby said.

“You would definitively see an increase in what you would have to pay on the sales tax,” Luby said. “Practically speaking, I would expect … to see an increased burden of taxes on students in the form of higher sales taxes and probably not a reduction of rents.”

Student renters would likely pay hundreds of dollars more per year through the proposed 1% sales tax increase.

“Not everyone owns property, and now they’re putting a tax on consumption to fix something else,” said Federico Chávez-Torres government sophomore and UT chapter president of Young Americans for Liberty. “It seems that you’re just putting the same Band-Aid on a different hole in the same sinking boat.”

The swap, filed as House Joint Resolution 3 by state Rep. Dan Huberty, R-Humble, would result in a $5 billion sales tax revenue increase for the biennial budget. The state’s base sales tax rate is currently set at 6.25%, and the increase to 7.25% would put the state on par with California, which has the nation’s highest rate. Local jurisdictions would also maintain their ability to raise it by another 2%, meaning the increase would put the sales tax rate at 9.25% in most cities.

Luby also said the sales tax is widely understood to be a regressive tax, meaning it puts a greater burden on lower-income people than the wealthy. Because of this, raising it has brought a lot of criticism from Democrats who called it “dead wrong.”

The sales tax increase/property tax rate cap swap is currently planned to be a constitutional amendment, a feat possibly more challenging than passing a standard bill by simple majority. A constitutional amendment requires two-thirds support from both chambers, no governor’s signature and final approval by voters in a statewide election.

Additionally, Gov. Greg Abbott has said he would only support the legislation if other property tax reform bills were also passed.

Joshua Blank, manager of polling and research at the Texas Politics Project, said using a constitutional amendment for the tax swap makes it both harder and easier to pass than a standard bill.

Constitutional amendments have been used in the past to give cover to lawmakers because of the requirement of final approval from voters, Blank said, resulting in a higher proportion of them voting in favor, which makes the two-third majority threshold easier to reach. Blank said constitutional amendments are typically used for issues associated with major spending or taxing components that may attract controversy in the electorate.

“They’re not themselves passing an increase to the sales tax — they are giving voters the opportunity to vote on an increase in the sales tax,” Blank said. “And while that might be a fine distinction, it’s one that legislators and the Legislature has used around issues of this sort.”

After passing through the Capitol, this type of legislation would be up for voter approval in a Constitutional Election in November.