Editor's Note: This story first appeared in The Daily Texan's February 26 print edition.

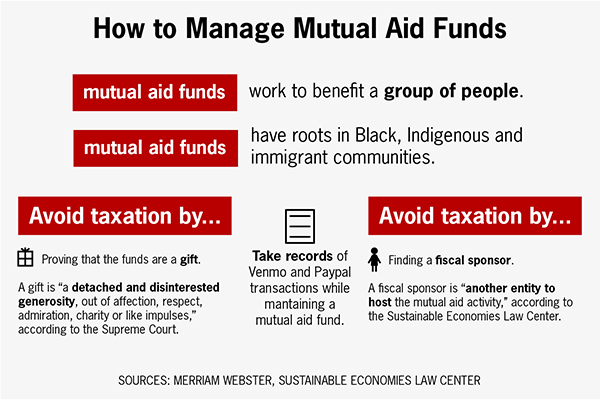

In the past year, many students have started mutual aid projects to support their communities through turbulent events, such as the COVID-19 pandemic, the Black Lives Matter movement and last week’s winter storms. Money from mutual aid funds can be subject to taxation.

Mutual aid is a means by which a community can serve one another without regulating who does or does not receive aid, said Michael Haber, clinical professor of law at Hofstra University. Unlike charity, which may have contingents on who receives aid based on income or immigration status, mutual aid works to incorporate everyone.

“The idea of mutual aid is we want to care for everyone in our community … and we’re going to be open to and listen to what people are saying they need,” Haber said.

If money for a mutual aid fund is being raised through Venmo or PayPal, the money can be subject to taxation, Haber said. The owner of a personal Venmo or PayPal account will receive a 1099-K form from the IRS, which will alert them that they have to pay taxes on the money if the account both accumulates $20,000 or more and accumulates 200 transactions, Haber said.

Haber said one way to receive a tax break on a mutual aid fund is to convince the IRS that the money in the fund is a “gift.” Haber said a gift is defined as “detached and disinterested generosity” and is excluded from taxable gross income.

Charlotte Tsui, staff attorney for the Sustainable Economies Law Center, said a mutual aid fund is the final recipient of the gift donation, but it can be characterized as a gift agent for tax purposes and act as a means to transfer gifts from donors to people in need.

Tsui said another way to receive a tax break for mutual aid funds is finding a fiscal sponsor or a tax-exempt organization that agrees to sponsor and receive the funds for a budding charitable project, such as a mutual aid fund. A fiscal sponsor is typically a nonprofit charitable organization, Tsui said.

“If a mutual aid secures a fiscal sponsor, then there’s more clarity and assurance that the mutual aid and its organizers don’t have to pay taxes on the donations they receive,” Tsui said.

Direct giving from the donor to the recipient can help mutual aid funds avoid filing taxes because no money flows through the mutual aid organization itself, Tsui said. Nonmonetary mutual aid can also serve a community, such as running errands for a neighbor, Tsui said.

Tsui said founders of a mutual aid fund may consider starting a separate bank account for the fund to remove a certain aspect of personal liability.

It is important for mutual aid projects to track their funds or even consider hiring an accountant, Haber said. He said paying a few hundred dollars for an accountant early on can save mutual aid founders the financial repercussions of being audited by the IRS.

“It’s important for them to try to get records of the money that came in and how they spent it,” Haber said. “For somebody who got a lot of money, the best approach may be to talk to an account, explain that these are gifts and ask them for help on how to present that.