Biden Administration continues postponement of student loan debt payments for graduates

April 9, 2021

Current students and alumni will not have interest accumulating on their public student loans and alumni can defer payment until at least Sept. 30 due to the economic impact of the COVID-19 pandemic, the U.S. Department of Education announced on March 30.

Kyle Morgenstein, an aerospace engineering graduate student who completed his undergraduate education at the Massachusetts Institute of Technology, said he has about $95,000 in student loan debt. He said not having to pay payments with interest accumulating has been helpful since he started his graduate studies during the pandemic.

“Not having to pay that for this period means I can put some money away (or) I can spend on other things,” Morgenstein said. “I just moved to Austin, so there’s moving expenses, so it’s definitely freed up a lot of other things that I wouldn’t have been able to do otherwise.”

When students go into graduate school right after completing undergraduate studies, they can continue to defer payments on their public loans until 6 or 9 months after graduating from their studies, depending on the type of loan, according to the federal student aid website.

Morgenstein said he planned to defer his payments until after he completed his graduate degree, but interest would have continued to accumulate without the COVID-19 relief. He said this would have caused him to pay $30,000 to $40,000 more in interest.

Angel Fletcher, radio-television-film freshman, said she plans to graduate in three years so she does not have to pay for a fourth year of college.

“I’d love to not rush my schooling and pace myself and make better grades,” Fletcher said. “Instead of having $80,000 in debt, maybe I’ll have $60,000 if I graduate in three years instead of four (years).”

Law professor Mechele Dickerson, who researches consumer protection and civil procedure, said there would be an economic benefit to canceling some student loan debt. She said if graduates constantly work towards paying off the student loans, they are delaying big life events such as buying a house or having children, which in the long run can have large-scale negative consequences for the economy.

According to The Hill, the Biden Administration is considering cancelling some public student debt through Congress.

Dickerson said it is hard to determine how much student loan debt forgiveness would be helpful to both the economy and the borrowers because of the disproportionate effect student loan debt has on low income students, Black students and Latinx students.

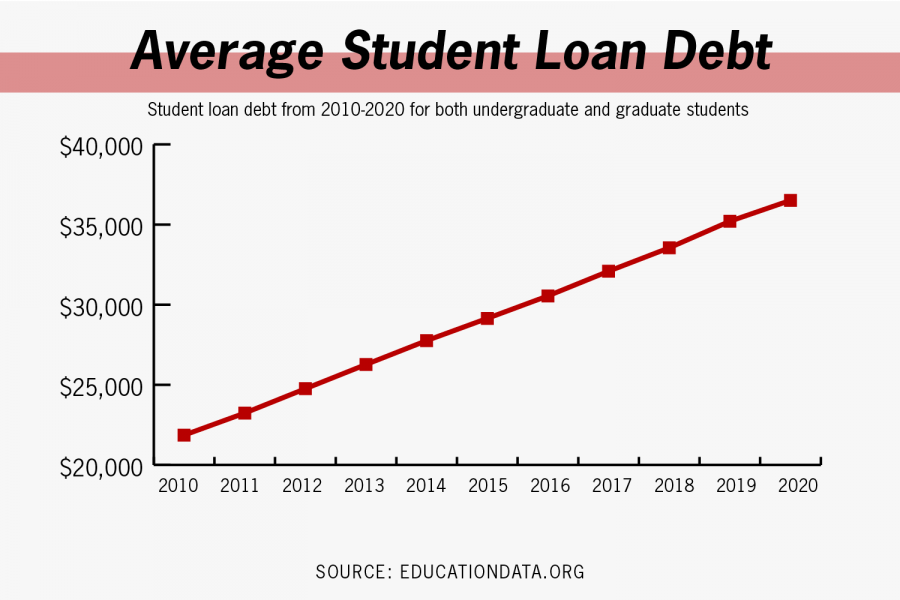

“The reality is when you look at the average amount of student loan debt, it’s about 25,000,” Dickerson said. “Most students don’t owe 60, 70 (or) $80,000 in student loan debt.”

Editor’s Note: This article first appeared in the April 9 issue of The Daily Texan.