Biden administration to forgive some student loan debt, UT students reflect

September 2, 2022

President Joe Biden announced Aug. 24 that his administration will cancel up to $10,000 of federal student loan debt for borrowers with an annual income below $125,000. Pell Grant recipients are eligible for $20,000 worth of debt cancellation.

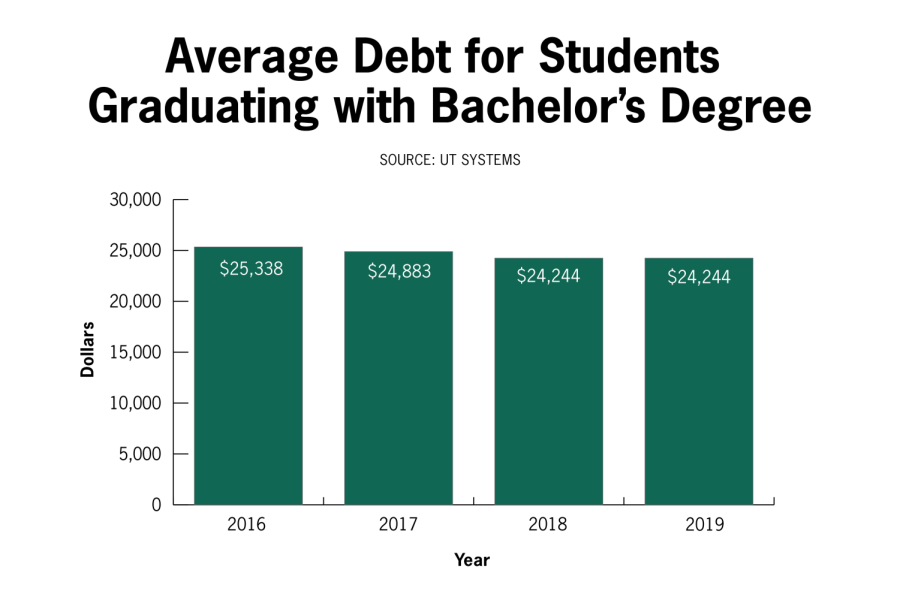

As of 2019, about 40% of UT graduates had student debt, with the average amount owed being $24,244, according to the University of Texas System Student Debt Dashboard.

Tuition rates for private and public universities have nearly tripled since 1980, according to the fact sheet from the White House. Despite the increase, many student aid opportunities like the Pell Grant have not increased in proportion to tuition over the years, leaving many students with no choice but to borrow money and bringing the federal student loan debt to $1.6 trillion.

Current students’ eligibility for Biden’s debt relief plan is determined by their individual income if filed as an independent, or by their parent or guardians’ household income if the student filed as a dependent on their FAFSA. Borrowers will be able to apply for the relief by the end of the year, according to the White House press release.

Tiffany Hughes, a higher education leadership graduate student, said she’s excited about the forgiveness program, even though it won’t relieve all of her loans.

“(The program) is not going to solve my issue. It’s not going to eradicate my student debt,” Hughes said. “What it will do, though, is help a bunch of people to not be underwater (from) student debt.”

When Hughes started college, she said her goal was to earn her undergraduate degree at no cost to her and her family, but ended up having to take out federal loans and credit cards to cover her tuition balance.

Hughes said she hopes her higher education will help her find a job with a sufficient salary to eventually pay off her loans, even with their growing interest.

“I understand how crippling student loan debt is for so many of us that are trying to attain degrees of higher education, particularly for working and middle-class folks,” Hughes said. “We are the highest borrowers but also the most negatively impacted when we leave (college) because social mobility is harder to achieve than they sell you on.”

Alicia Amberson, a studio art and art history senior, said she is beginning her career as an artist without any student loans, a comparative advantage to those who have to decide whether seeking a college degree is worth the long-term repayment.

“I’m just lucky, but a lot of people aren’t,” Amberson said.

Linguistics graduate student Paige-Erin Wheeler, whose student debt will be nearly canceled as a result of the forgiveness program, said it’s almost impossible for working and middle-class students to finish their degree paths without some debt.

“When my parents went to college, my mom waitressed for a summer and made enough money to pay for an entire year’s worth of college,” said Wheeler, president of the Graduate Student Assembly. “(Now), you could waitress until the end of your days and you would not make enough money to pay for college.”

Hughes said even though the loan forgiveness program is a positive step, she hopes more progress is made to address the student debt problems faced by many Americans.

“It’s a decent first step. I think (Biden’s loan forgiveness plan) says that this type of initiative can be accomplished,” Hughes said. “So I’m trying to be hopeful that this is a first step and not the (only) step.”