Cosigning education’s future

March 10, 2023

What’s your morning routine? Most students get ready and dressed for the day, putting their laptops, books and $37,574 of federal student loan debt in their bags before class. Some majors will not see an economic return on their investment until the middle of their careers.

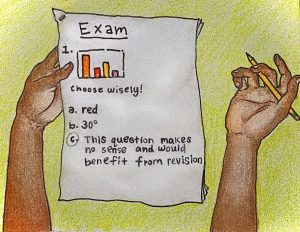

Given the rising costs of college, universities nationwide are becoming complacent in allowing students to accrue debt. High schoolers are throwing darts at the board to identify what they want to study in a university with little to no guidance on the long-term implications of their decisions.

UT should implement a program to cosign student loans and a major-blind admissions process with administrational oversight.

Expecting students, especially first-generation college students, to have a comprehensive understanding of balancing finances that have a lifelong impact is absurd. For many, agreeing to thousands of dollars of student loan debt is just as easy as enrolling in college.

We are trapping young Americans in a vicious cycle of debt. Total student loan debt has increased at an annual rate of 7.78% since 2006. The current monthly cost of living in Austin, without including rent, is $1,075.80. Including rent for a three-bedroom apartment split three ways, monthly expenses are at least $2,512.50, or $30,150 annually. For all majors outside of STEM, business or health, their bottom line is greater than their earnings until they reach the middle of their careers.

UT cosigning student loans invests in student success, leverages the University’s resources and upholds our motto, “A cultivated mind is the guardian genius of democracy.”

Without having to balance the weight of credit on their own, students could establish personal credit, have access to better loan terms, reduce the financial burden on the government and improve the financial health of the United States.

Sean Williamson graduated from UT, recently earning his executive master’s in business administration, and presented on this topic in one of his classes.

“Right now, the U.S. government, they essentially carry all the risk of making these loans,” Williamson said. “(When universities work with the government to cosign student loans) we all have a shared incentive, shared alignment in the success of these individual students.”

On average, the current UT baccalaureate student will graduate with $24,244 in debt, with 40% of all graduating students indebted. Their earnings will only surpass the cost of living and debt five years after graduating.

Kathleen Harrison, assistant director of communications for the Office of the Executive Vice President and Provost, declined to comment for this column.

The obvious objection to cosigning student loans is the default rate and added financial risk to UT. The occasional student defaulting on their loan would not hurt UT as much as a whole graduating class of 8,000 or more defaulting.

Cosigning student loans may impact University admission policies, leading to a shift toward majors with high-earnings potential rather than those with lesser earning potential. This would pervert the higher purpose of education to produce ideas into a simple job-manufacturing machine.

To prevent the University from prioritizing some majors, UT could implement an oversight committee to ensure that specific majors aren’t favored over others.

College debt has become a national issue in the 21st century. To mitigate the weight of student debt and promote success, UT could build a program that focuses on cosigning student loans. Though this system still needs to be perfected and would need to be tested before configuration, taking any step toward helping students is the right direction.

Dylan Woollard is a finance sophomore from Austin, Texas.