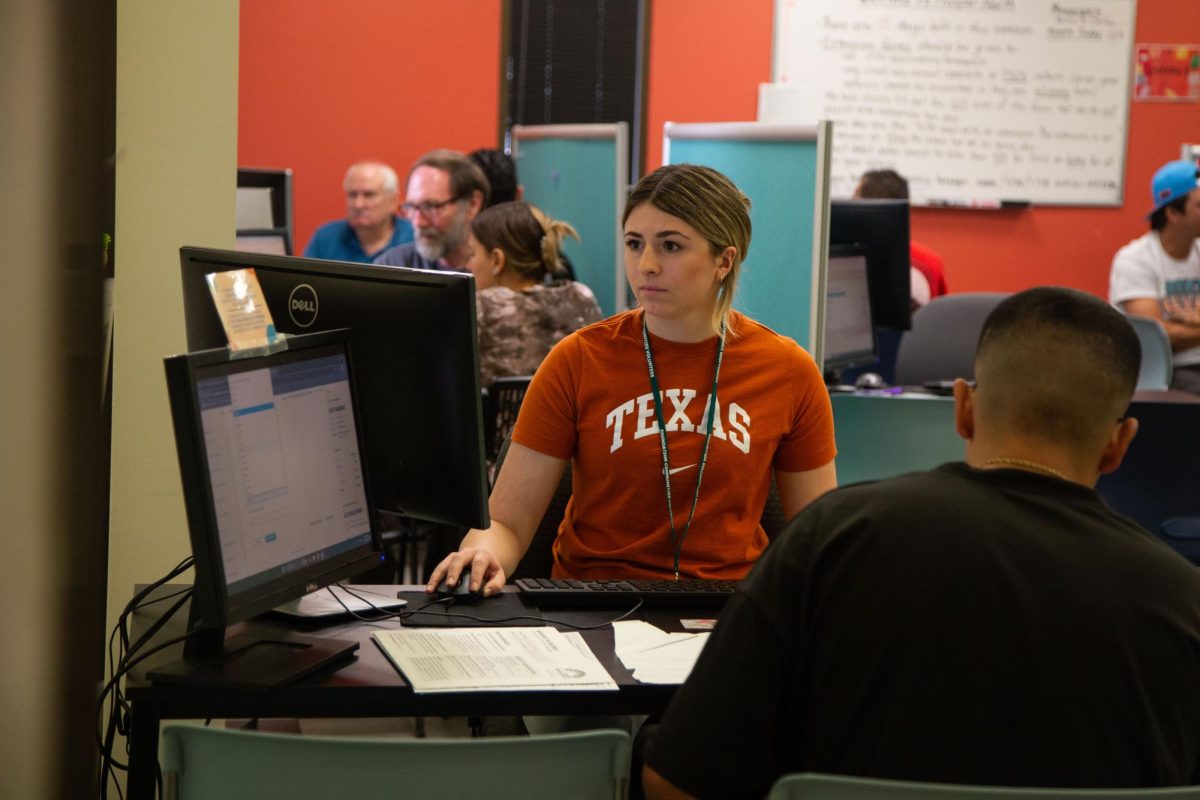

A postdoctoral physicist and his wife, who recently immigrated from India, entered a bustling room of W-2 and 1099 forms, looking to file and understand the taxes of their new country. Enthusiastically, Christian Tinoco Lopez, a professional accounting master’s student, undertook their complex case to find them the proper referral.

“It was sort of a back-and-forth battle between me and the tax code, trying to solve the puzzle,” Lopez said. “Seeing the satisfaction and the gratitude they had in their eyes was enough of a reward for any man.”

This year, Foundation Communities celebrates its 20th tax season in partnership with UT as hundreds of student volunteers help prepare taxes for low-income families and individuals yearly. Through the Tax Practicum course, students must take a comprehensive 20-hour tax preparation course before they begin their required 55 hours working for Foundation Communities. The students constitute the majority of a volunteer force that will aid 18,000 people this year alone.

Jackie Cuellar, director of corporate and volunteer engagement at Foundation Communities, said that there are not a lot of programs like this around the country, and none are equivalent to the one at the McCombs School of Business.

“We’ve also been fortunate enough to have students come through the program that have benefited from programs like ours with their own families,” Cuellar said. “Being able to give them an opportunity to give back to other families has been really great.”

As one such student, Lopez’s parents immigrated from Guanajuato and belonged to a lower tax bracket within the United States. He said the tax implications are not necessarily well explained, so his job is to help them get a refund and teach them to interpret and understand the rules for the future.

“A lot of that (understanding of tax refunds) is really something I wish my family had when we first came to the United States,” Lopez said. “Being able to share that knowledge with the rest of the immigrant community is something that’s an invaluable lesson. It’s taught me a bunch about how much our system is pretty complex for no reason.”

LiNiya Simon, a professional accounting master’s student, said she understands the nuances of the low-income perspective of taxes, coming from a family that doesn’t have much. After filing an education credit for a Spanish-speaking single mother who received a large refund, the woman asked a translator to tell Simon, “God bless you, and I hope that this returns to you times 10.”

“It was really touching to know that I was helping a single mom,” Simon said. “Something so mundane for me, and didn’t take more than 20 minutes, absolutely changed her life. It was a way of providing assistance, not only to herself but also for her son, who’s currently in college too.”

Donna Johnston-Blair, a co-professor of the Tax Practicum, said through the class, students come to see how onerous taxes are and the impact they can have on low-income people.

“This course is going to be a course you take with heart,” Johnston-Blair said. “It’s got to be because you really care. You’ve got that kind of caring-for-others personality, and you really feel an attachment to the community.”