The cost of higher education is on the rise, and while students may pay a substantial price on the front end in the form of student loans, the reward of a college degree is worth it, according to Todd J. Zywicki, a George Mason University law professor.

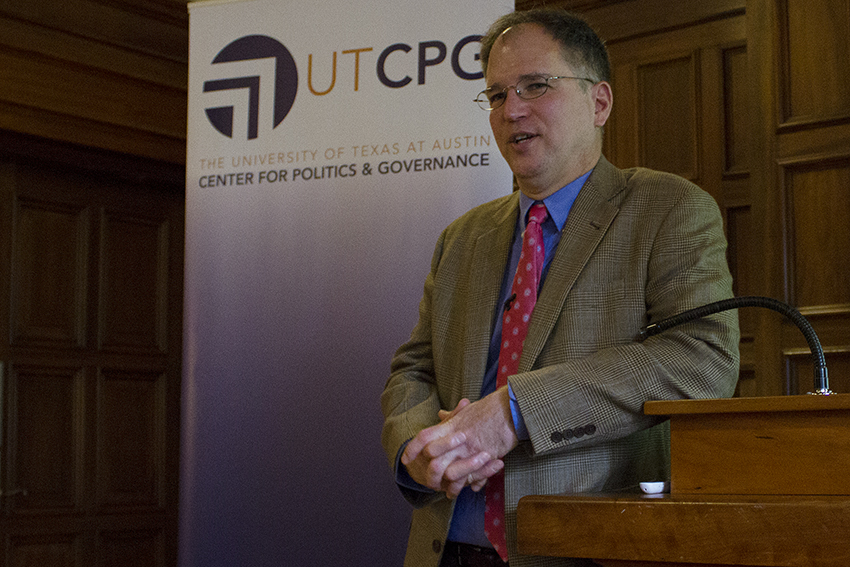

At a lecture hosted by the UT Center for Politics and Governance on Thursday, Zywicki discussed the economic logic and public policy behind student loans and the factors contributing to the decrease in college affordability.

Ryan Streeter, the executive director for the Center, which aims to engage students on issues of public policy making and politics, said student debt is having long-term effects on graduates.

“The rising cost of college is now having a direct impact on the ability of young people to buy homes and to buy cars,” Streeter said. “Like the speaker said, as student loans have gone up, credit scores have gone down and home ownership has gone down, and this then affects the wealth accumulation for young people.”

Zywicki said due to the rising price of college, students end up paying more in order to recover from student loans. He said this could set them back, delaying them from getting established in other ways, such as buying a house.

“The cost of going to college is actually a function of different costs,” Zywicki said. “There’s how much you pay to go to college, tuition, but [what] we often don’t focus on is the forgone income associated with going to college. The cost of going to UT is not just the tuition you pay, but it’s also the $30,000 or $40,000 that you could have earned working rather than going to college.”

However, Zywicki said this makes finishing college and obtaining a degree more vital, as defaulting would lead to major losses in a student’s investment in higher education.

“More recent graduates are more likely to default almost immediately after graduating from college than are earlier generations,” Zywicki said. “I think that there is a buzz out in the world that you don’t have to pay your student loans.”

Psychology freshman Heather Chang said an expectation for a student loan bailout is not the reason behind an increase in defaults.

“Students shouldn’t be expected to cope with such dramatic price increases,” Chang said. “Especially in a society that places so much value in higher education to the point you cannot get a good job without a college degree.”