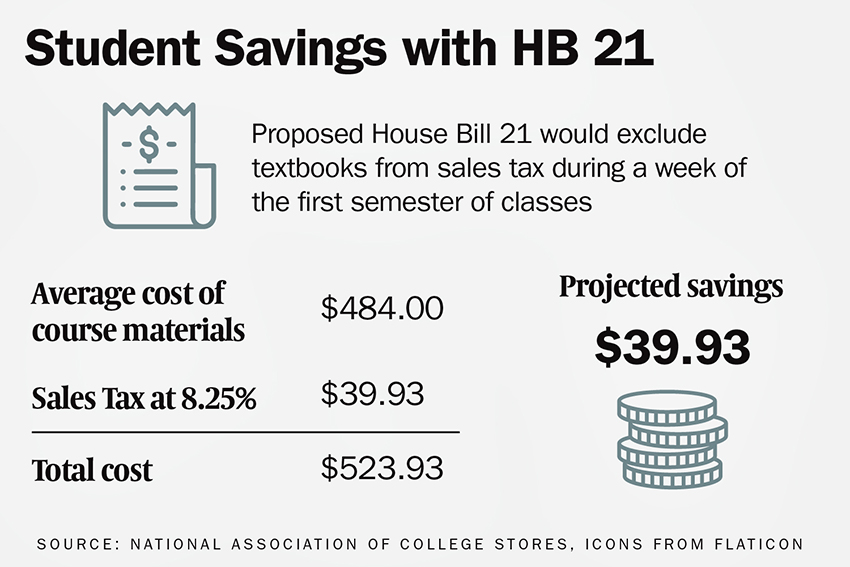

The average college student spends more than $485 on textbooks annually, and with Austin’s 8.25 percent sales tax, the total cost for course materials is around $525, said Cheryl Phifer, president and CEO of the

University Co-op.

But House Bill 21, authored by state Rep. Terry Canales, D-Edinburg, would change that by excluding course materials from sales tax for a week at the beginning of each semester.

If passed, Phifer said she estimates the bill will save students $40 annually.

“From my perspective, it’s a really good thing for students because it’s another way for them to save money on course materials, which we all know are expensive,” Phifer said.

Canales said he filed HB 21 to help give students a break when it comes to their education.

“Making education more affordable should be the utmost priority of the state of Texas and not collecting sales tax on the students who are generally not the wealthiest people on the planet,” Canales said.

Canales said the government makes more money when students graduate college, get jobs and become productive members of society, rather than through a mere sales tax on textbooks.

“When someone is making money, they have buying power, and that buying power is equivalent to sales tax,” Canales said. “So on the back end, (the government is) likely to make more money off a long-term consumer purchaser than off a one-time purchase or limited purchase of textbooks.”

Phifer said the bill would not have any negative impact on the Co-op’s sales.

“Ultimately the state is the one that’s making that decision and essentially making that contribution of not charging the sales tax,” Phifer said. “For the Co-op, it doesn’t have an impact because while we collect the sales tax and we have to remit the sales tax, that’s not money that ever stays at the Co-op.”

Architectural engineering sophomore Tiffany Gilkes said she was lucky her parents helped her pay for some of her textbooks, but she knows not all students have that privilege.

“After having to pay for tuition and housing, my parents really didn’t have extra money to send $500 just for textbooks, so I personally had to break into my savings to pay for some of it,” Gilkes said in an email. “The worst part about spending so much money is that I barely needed to use the books for my classes.”

Excluding textbooks from the sales tax could make a big difference in a student’s finances, Gilkes said.

“Spending $484 on textbooks alone is just ridiculous and way too high, especially if most students only take 4 to 5 courses at a time,” Gilkes said. “That $40 of taxes can go to paying a portion of their bills or groceries.”

While Canales is hopeful HB 21 passes, he said he knows he will have to convince his fellow legislators of the bill’s importance.

“I would hope that my colleagues would see the light and see that this is good, common sense sales tax reform,” Canales said. “It should resonate with people who are trying to bolster the economy rather than suppress it.”