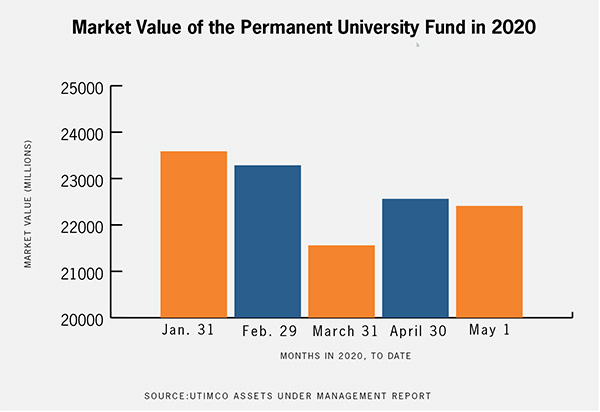

From January to May, the Permanent University Fund’s assets under management, which help support the UT System, have lost 5% in market value due to the coronavirus pandemic, according to the May performance summary from The University of Texas Investment Management Company.

The fund’s assets under UTIMCO’s management include public stocks, real estate and gold, according to the 2019 Permanent University Fund financial statement. Yearly distributions from the Permanent University Fund, an endowment fund, are made to support institutions in the UT and Texas A&M University systems.

In comparison, the fund gained 1.6% in assets in the first five months of 2019, according to the UTIMCO Assets Under Management report.

The UT system received $1.06 billion from the fund for the 2019-2020 school year, according to the UT System May 2019 agenda book. The money can be used for operations at UT-Austin and the UT System administration, per the Texas Constitution, UT System spokesperson Karen Adler said.

“The Permanent University Fund is one of several critical sources of revenue that collectively drive the budgets for UT institutions,” the UT System said in a statement.

More than $160 million of a one-time distribution from the fund went to support UT-Austin’s endeavor to cover tuition for students whose families have an annual household income of $65,000 or less beginning in the fall, according to a July 9, 2019 UT News release.

The Permanent University Fund receives a majority of the oil and gas revenue generated by 2.1 million acres of land in West Texas owned by the UT System. The land revenue is invested and managed by UTIMCO, according to their PUF investment policy statement.

Because the pandemic caused a decrease in oil prices, University Lands, which manages the lands in West Texas, is projecting revenue will decline from about $1 billion in 2019 to around $500 million in 2021, according to the statement from the UT System.

“The steep decrease in University Lands revenue … is not likely to significantly reduce distributions this year, but the cumulative impact in future years could be substantial,” the statement said.

UTIMCO manages five endowment funds, including the Permanent University Fund, for the UT and Texas A&M systems. Rich Hall, UTIMCO deputy chief investment officer, said the potential University Lands revenue loss may impact the overall size of the endowments and how quickly they grow if the revenue received from University Lands is “meaningfully lower for a prolonged period of time.”

From February to March, the fund’s assets under management lost approximately $1.7 billion in market value, or 6.6%, according to UTIMCO’s March performance summary. This decline is the largest single-month decline in assets under management for the Permanent University Fund since its inception in the Texas Constitution in 1876, Adler said.

It is normal for the endowment funds to lose value when markets suffer a decline due to changing economic conditions or unexpected shocks such as COVID-19, Hall said.

Hall said this does not mean that the Permanent University Fund suffered long-term harm, and it will make the distributions needed to support the UT and A&M systems without fail.

UTIMCO runs the endowments with a long-term mindset and is diligent about managing the endowments to prepare for shocks such as COVID-19, recessions or other market corrections, Hall said.