University land endowments raise equity, environmental concerns

July 28, 2022

Editor’s note: This article first appeared in the July 26, 2022

As state-designated land endowments benefit the University of Texas and Texas A&M University systems, a degree of revenue has increased due to elevated gas prices, concerns regarding funding equity and their environmental impact as a result of oil drilling on these lands.

UT System spokesperson Karen Adler said in an email that elevated gas prices and inflation will increase the Permanent University Fund’s revenue, but only in the short run.

“Distributions are not tied to the annual revenue generated by PUF Lands,” Adler said. “This is designed to protect the PUF from fluctuation in oil prices and volatility in the financial markets — providing stable and predictable long-term funding to the UT and A&M institutions that benefit from the PUF.”

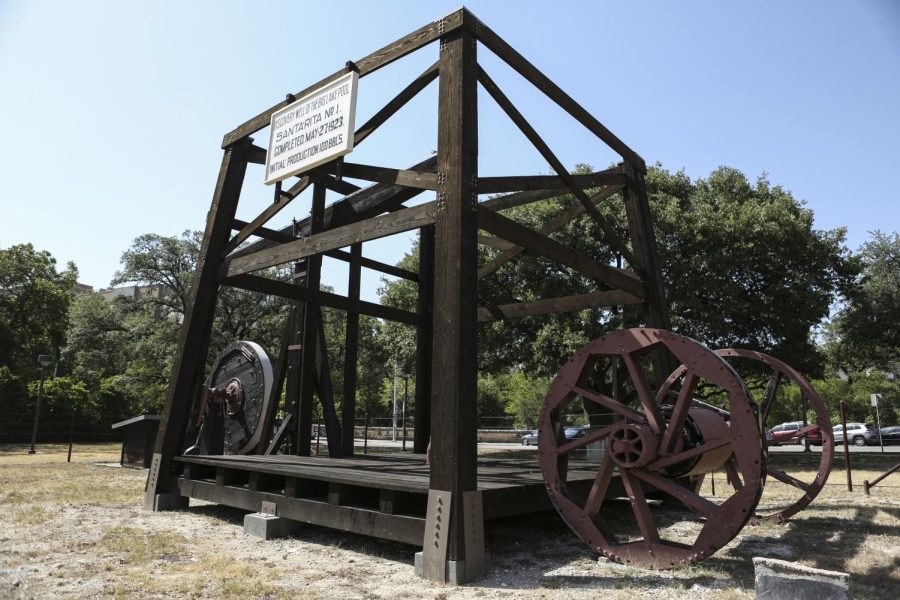

The Texas Constitution and subsequent legislative action gifted the UT and A&M university systems approximately 2.1 million acres of West Texas land for continuous mineral and surface management to promote higher education beginning in 1876. The resulting revenue is placed in the Permanent University Fund and Available University Fund.

Adler said the mineral income, including oil and gas bonuses, rentals and royalties, is placed into the PUF, which acts as a permanent, collective endowment for all UT and A&M institutions and agencies. Surface leases for grazing, wind and solar energy are directly deposited into the AUF in addition to the annually distributed returns gained through the PUF’s investments.

“Any increase in revenue to the PUF directly benefits more students, patients and Texans, while also driving life-changing and life-saving research,” Adler said.

The UT System has the second largest endowment of any United States university at roughly $30 billion, only behind Harvard University, according to previous reporting by The Daily Texan. The AUF also made up 12% of the University’s nearly $3.4 billion budget for the 2020-2021 school year.

“The scale of the Permanent University Fund’s impact on the UT and A&M systems is substantial, as is the number of institutions, students and Texans who benefit from it,” Adler said. “UT and A&M institutions will rely on funding from the PUF to keep pace with enrollment growth and the need for more classrooms and labs as it builds Texas’ workforce.”

Other public universities in Texas outside of the UT and A&M systems have raised equity concerns in the state’s funding, as when the constitution was written, many modern Texas universities didn’t exist. Some university systems, such as the University of Houston and Texas Tech University systems, have called to amend the PUF to increase its beneficiaries or create a new state fund to bridge Texas higher education financial disparities.

“We look forward to working with the legislature and state leaders during the 2023 session to secure appropriate funding for our institutions and the students they serve,” Mike Wintemute, vice chancellor for marketing and communications at the Texas State University System, said in an email.

William R. Murphy Jr., CEO of University Lands, said the PUF includes “extensive” wind and solar power generation with expectations of considerable growth in emerging energy sources. There are nine clean energy projects and 10,000 producing oil wells currently occupying PUF lands, according to University Lands.

“University Lands is a leader in promoting and supporting the efforts of Permian Basin operators and the oil and gas industry to continuously develop effective methods and practices to provide cleaner energy,” Murphy said.

Eleanor Hammersly, education director for Students Fighting Climate Change, said the growing severity of climate change makes the University’s ties to oil both irresponsible and upsetting. Hammersly, a music performance senior, expressed SFCC’s desire for the University to eventually divest its financial involvement in the oil and gas industry. Harvard University ceased its investment into fossil fuel companies in favor of green energy last year.

“It is more and more apparent that companies and institutions who have the money to invest in climate-change-causing industries are what exacerbates the climate crisis most,” Hammersly said in an email.

Editor’s note: This story has been corrected to clarify that the UT System has the second-largest endowment in the country, not UT-Austin. The Texan regrets this error.