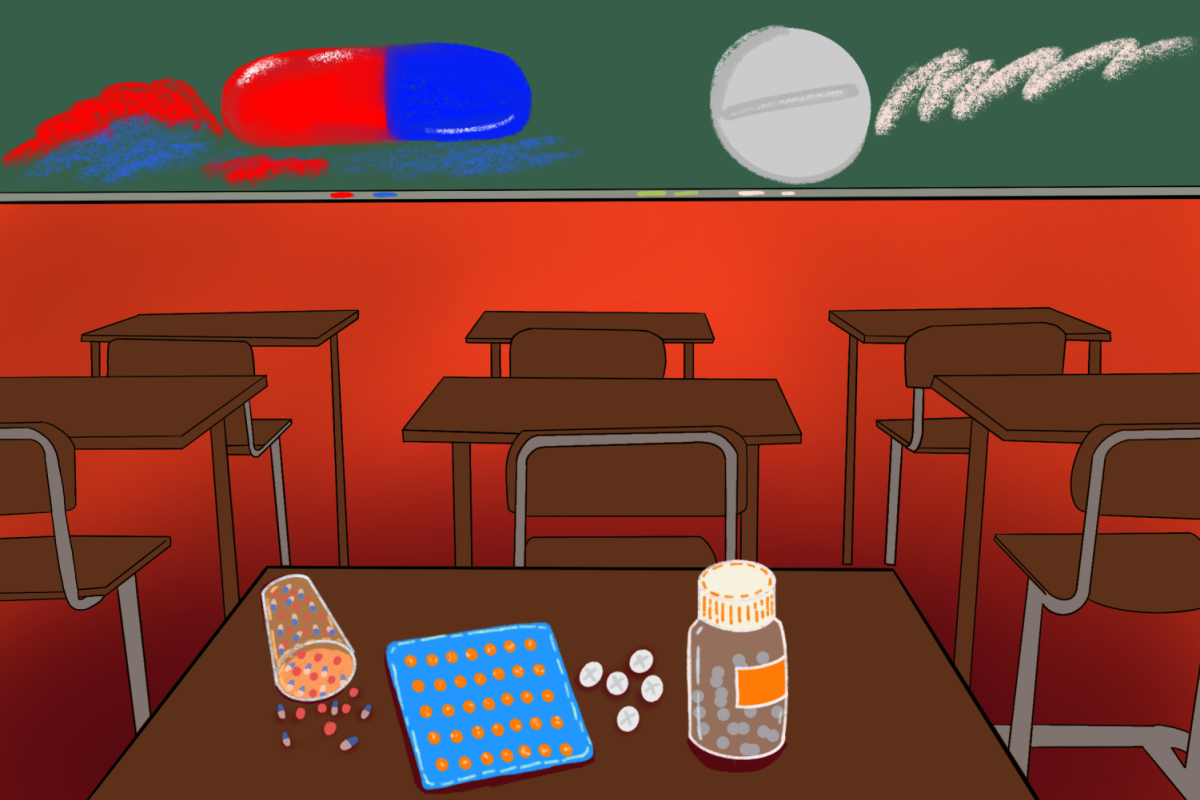

On June 30, the United States Supreme Court struck down President Joe Biden’s program to forgive up to $20,000 in student loan debt, citing an overreach of authority by the President and Secretary of Education.

The Court ruled 6-3 in Biden v. Nebraska, where Nebraska and several other states sued the Biden administration for unlawfully exercising presidential power without explicit Congressional approval.

In his majority opinion, Chief Justice John Roberts said the Higher Education Relief Opportunities Act of 2003, which gives Secretary of Education Miguel Cardona authority to “waive or modify” regulations and requirements as it pertains to federal student loan payments in response to a national emergency, did not justify an outright cancellation of student loans. Roberts said the “basic and inherent tradeoffs inherent in a mass debt cancellation program are ones Congress would have likely intended for itself” and that Cardona failed to point to direct Congressional authorization.

“The Secretary’s comprehensive debt cancellation plan cannot fairly be called a waiver—it not only nullifies existing provisions, but augments and expands them dramatically. It cannot be mere modification, because it constitutes ‘effectively the introduction of a whole new regime,’” Roberts wrote. “However broad the meaning of ‘waive or modify,’ that language cannot authorize the kind of exhaustive rewriting of the statute that has taken place here.”

Students who applied and were approved for the loan forgiveness program before it was contested will not secure the relief they were assured. Sophie Beasley, a sustainability studies and geography senior, is one such student.

Beasley said she was fortunate not to need too many loans, but the program still would have helped her.

“I think I can still pay back my loans within a year of graduating, hopefully,” Beasley said. “But, I would have graduated debt free if this program had been passed, so it’s just having to budget more carefully and stay more on track of my finances, but I feel like any student who does have to take out loans is already very financially responsible.”

With loan repayments scheduled to resume this fall after a government-initiated pause during the pandemic, Beasley said the program’s continuation would have taken people like her out of the repayment system and relieved some of the pressure put on loan service systems to process mass paybacks.

In light of the Supreme Court’s ruling, the Biden administration announced it would pursue other avenues to forgive student loan debt. This includes the Secretary of Education using his authority under the Higher Education Act and initiating an “on-ramp” system from Oct. 1, 2023, to Sept. 30, 2024 “so that financially vulnerable borrowers who miss monthly payments during this period are not considered delinquent, reported to credit bureaus, placed in default or referred to debt collection agencies.”

The administration also finalized the Saving on a Valuable Education plan that will be introduced later this summer before student loan repayments resume. According to a White House press release, the SAVE plan will “cut borrowers’ monthly payments in half, allow many borrowers to make $0 monthly payments, save all other borrowers at least $1,000 per year and ensure borrowers don’t see their balances grow from unpaid interest.”