Student loans seem to be a big looming cloud over students’ heads that only continues to grow larger with rising tuition costs. But the Texas Exes could be the solution.

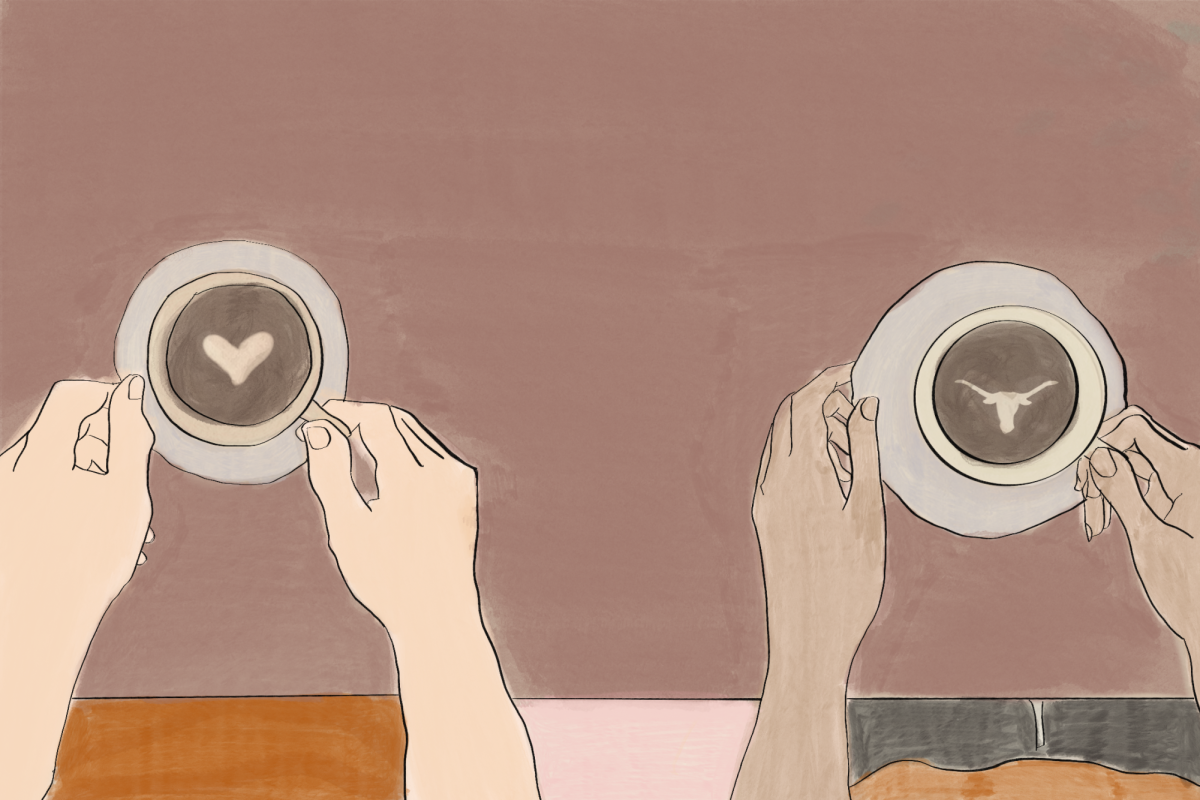

Last year, Stanford alumni created SoFi, a company that funds student loans with investments from alumni. The name refers to the social and financial benefits that both the alumni and students will receive through this program. SoFi is based off of a peer-to-peer lending model, where students receive low-interest loans from alumni of their school. In doing so, SoFi builds a network for students to connect with alumni who can eventually become their mentors.

This initiative seems like a win-win for both students and alumni. According to the alumni page on SoFi’s website, the company advertises, “do well for yourself, while doing good [for] others.” Alumni have the advantage of investing in a student for the social benefits of helping the student out while also receiving a return on their investment. SoFi CEO Mike Cagney claims, “SoFi investors receive a 5-percent to 8-percent return on their loans and view it as a socially responsible investment, as opposed to a charitable donation.” On the other hand, students receive low-interest loans in addition to a new network of alumni who can help them start their careers when they graduate.

This creative idea comes at the perfect moment as the student loan crisis has reached an all-time high. According to a recent article in the Wall Street Journal, the current total student loan debt has surpassed the $1-trillion mark. To put this amount in perspective, the nation’s credit card debt is just under $800 million. It is clear that there needs to be a solution to the nation’s student loan crisis.

Although SoFi may not significantly lower the national student loan debt, the company has broken the mold for student loans and created a system that builds solidarity between students and lenders. Instead of an abstract government entity loaning a student money, the student receives a loan directly from alumni. As alumni invest in current students, they imply, “I believe in you.” In turn, students have an incentive to live up to a higher potential because someone is personally invested in his or her future.

So what would this program look like at UT? It could work very nicely. Texas Exes would be encouraged to give back to the University in a more tangible way than through a donation fund, while students would receive low-interest loans and an alumni network for their careers in return. In addition, alumni would be more willing to assist these students after graduation since they had been investing in them for the previous four years.

It is to UT’s advantage to create a program like SoFi. This kind of peer-to-peer lending will give the University a competitive advantage among other schools. Not only will it offer attractive low costs for student loans, but it will also strengthen alumni engagement.

Through an initiative like SoFi, Texas Exes can break some sunshine through the student-loan cloud.

Dafashy is a Plan II senior.