Some of the Republican presidential candidates have proposed a flat tax plan that they claim is fair and fiscally conservative. The truth, however, is the exact opposite. A flat tax proposal would eliminate the current seven income tax brackets and replace them with one flat tax that applies to everyone, rich or poor. In contrast, a fair and fiscally conservative tax plan would have multiple tax brackets, where the rich pay more than the poor, while also not increasing the nation’s budget deficit and national debt.

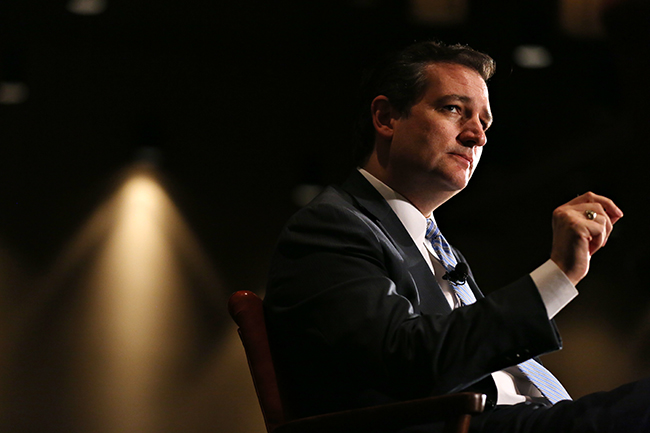

One of the candidates, Rand Paul, argues that under his fair and flat tax plan, “no one of privilege, wealth [should] pay a lower rate than working Americans.” However, it is also not fair to let billionaires like Donald Trump and George Soros pay the same rate as parents struggling to support their children at UT. Currently, those who make more than $413,200 a year are in the top tax bracket and are taxed at the marginal rate of 39.6 percent. Under Paul’s plan, they would only have to pay 14.5 percent, while under Ted Cruz’s plan, they pay even less at 10 percent.

Tax law professor Calvin Johnson said in an email that Cruz and Paul’s flat tax proposals “would shift the tax burden from rich to poor and increase the deficit burden on our children.” Cruz and Paul argue that their proposals would eliminate loopholes for the rich, but none of the current deductions bring down the effective tax rate of the rich anywhere close to 14.5 percent. For example, Warren Buffett, who exploits these loopholes, still pays an effective tax rate of 31.1 percent. Thus, under these flat tax plans, millionaires and billionaires would be getting an enormous tax cut.

The Reagan administration rejected the flat tax for these exact reasons. At a 1982 Senate Finance Committee hearing, the Reagan Treasury Department testified that any flat tax plan would involve a significant redistribution of tax liability away from the wealthy and onto average taxpayers.

Additionally, these flat tax plans will further increase the budget deficit and national debt. Proponents claim that the economic growth from these tax cuts will make up for the lost revenue, but Johnson dismisses these claims.

“We are on the part of the Laffer curve in which cuts in tax rates will increase the deficit and projections that tax cuts will increase our economy in the face of these deficits are just fantasy smoke dreams,” Johnson said.

As fiscal conservatives, we need to focus on balancing the budget and paying down our national debt instead of giving tax cuts to the rich. Our national debt stood at $10.6 trillion when Obama took office and is now at $18.5 trillion. At a time when we need to be cutting our spending and increasing our revenue, flat tax plans that decrease our tax revenue will only take us down the path of countries like Greece — completely broke and unable to pay off our debt.

Hung is a second-year law student from Brownsville.